UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

For the quarterly period ended

or

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

(Address of principal executive offices) |

|

(zip code) |

(

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

|

|

|

|

|

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

☑ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes

Number of shares of common stock outstanding as of November 11, 2021 was

TABLE OF CONTENTS

|

|

|

|

|

Page No. |

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

|

19 |

|

Item 3. |

|

|

34 |

|

|

Item 4 |

|

|

34 |

|

|

|

|

|

|

|

|

Item 1. |

|

|

36 |

|

|

Item 1A. |

|

|

36 |

|

|

Item 2. |

|

Unregistered Sales of Equity Securities and Use of Proceeds. |

|

36 |

|

Item 3. |

|

|

36 |

|

|

Item 4. |

|

|

36 |

|

|

Item 5. |

|

|

36 |

|

|

Item 6. |

|

|

37 |

i

PART 1. - FINANCIAL INFORMATION

Item 1. Financial Statements.

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Financial Statements

(Unaudited)

For the three months ended September 30, 2021

(expressed in US dollars unless otherwise noted)

1

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Balance Sheets

(In thousands, except par value amounts)

|

|

|

|

|

|

|

September 30, 2021 |

|

|

June 30, 2021 |

|

||

|

|

|

Note |

|

|

$ |

|

|

$ |

|

|||

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses, deposits and other |

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical trial deposit |

|

|

4 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical trial deposit |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

Property, equipment and intangibles, net |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Related party payables |

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Milestone payment liability |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued and outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

(June 30, 2021 – |

|

6,7 |

|

|

|

|

|

|

|

|

|

|

|

(June 30, 2021 – 2 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Accumulated deficit |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Accumulated other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nature of operations, corporate history, going concern and management plans (note 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsequent events (note 10) |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

2

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

Three months ended September 30, |

|

|||||

|

|

|

Note |

|

|

2021 |

|

|

2020 |

|

|||

|

|

|

|

|

|

|

$ |

|

|

$ |

|

||

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger costs |

|

|

3 |

|

|

|

— |

|

|

|

|

|

|

In-process research and development |

|

|

3 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Other income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of deferred loan costs |

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

Interest, net |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Net loss for the period |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Computation of basic loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Deemed dividend recognized on beneficial conversion features of Series C Preferred stock issuance |

|

|

7 |

|

|

|

— |

|

|

|

( |

) |

|

Series A Preferred cash dividend |

|

|

7 |

|

|

|

( |

) |

|

|

( |

) |

|

Series B Preferred stock dividend |

|

|

7 |

|

|

|

— |

|

|

|

( |

) |

|

Series C Preferred stock dividend |

|

|

7 |

|

|

|

( |

) |

|

|

— |

|

|

Net loss for the period attributable to common stockholders |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Basic and fully diluted loss per share |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Basic and fully diluted weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

3

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Statements of Stockholders’ Equity

(Unaudited)

For the three months ended September 30, 2021

(In thousands)

|

|

|

Number of shares |

|

|

Common stock $ |

|

|

Additional paid-in capital $ |

|

|

Accumulated other comprehensive income $ |

|

|

Preferred stock $ |

|

|

Accumulated deficit $ |

|

|

Stockholders' equity $ |

|

|||||||

|

Balance - June 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Issuance of shares and warrants - net of issue costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Conversion of Series C Preferred stock to common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

Exercise of 2020 Investor Warrants for cash |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Exercise of pre-funded warrants for cash |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Warrants issued for services |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Stock option expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Series A Preferred cash dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Series C Preferred stock dividend |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance - September 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

4

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Statements of Stockholders’ Equity

(Unaudited)

For the three months ended September 30, 2020

(In thousands)

|

|

|

Number of shares |

|

|

Common stock $ |

|

|

Additional paid-in capital $ |

|

|

Accumulated other comprehensive income $ |

|

|

Preferred stock $ |

|

|

Accumulated deficit $ |

|

|

Stockholders' equity $ |

|

|||||||

|

Balance - June 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Adgero merger (note 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Issuance of Series C Preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

Series C placement agent warrants |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

Series C Preferred stock share issuance costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Deemed dividend recognized on beneficial conversion features of Series C Preferred stock issuance |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Exercise of warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Warrants issued for services |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Stock option expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

Series A Preferred cash dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Series B Preferred stock dividend |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

Balance - September 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

5

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

Three months ended September 30, |

|

|||||

|

|

|

|

|

|

|

2021 |

|

|

2020 |

|

||

|

|

|

Note |

|

|

$ |

|

|

$ |

|

|||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

5 |

|

|

|

|

|

|

|

— |

|

|

In-process research and development |

|

|

3 |

|

|

|

— |

|

|

|

|

|

|

Change in fair value of milestone liability |

|

|

3 |

|

|

|

( |

) |

|

|

— |

|

|

Interest expense |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Amortization of deferred loan costs |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Warrants issued for services |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Stock option expense |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses, deposits and other |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Related party payables |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Net cash used in operating activities |

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash acquired on merger with Adgero |

|

|

3 |

|

|

|

— |

|

|

|

|

|

|

Net cash provided by investing activities |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net proceeds from the issuance of shares and warrants |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Warrants exercised for cash |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

Proceeds from loan |

|

|

|

|

|

|

— |

|

|

|

|

|

|

Series A preferred cash dividend |

|

|

6 |

|

|

|

( |

) |

|

|

( |

) |

|

Net cash provided by financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents – beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents – end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary information (note 8) |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

6

Kintara Therapeutics, Inc.

Notes to Condensed Consolidated Interim Financial Statements

(Unaudited)

September 30, 2021

(expressed in US dollars and in thousands, except par value and per share amounts, unless otherwise noted)

|

1 |

Nature of operations, corporate history, and going concern and management plans |

Nature of operations

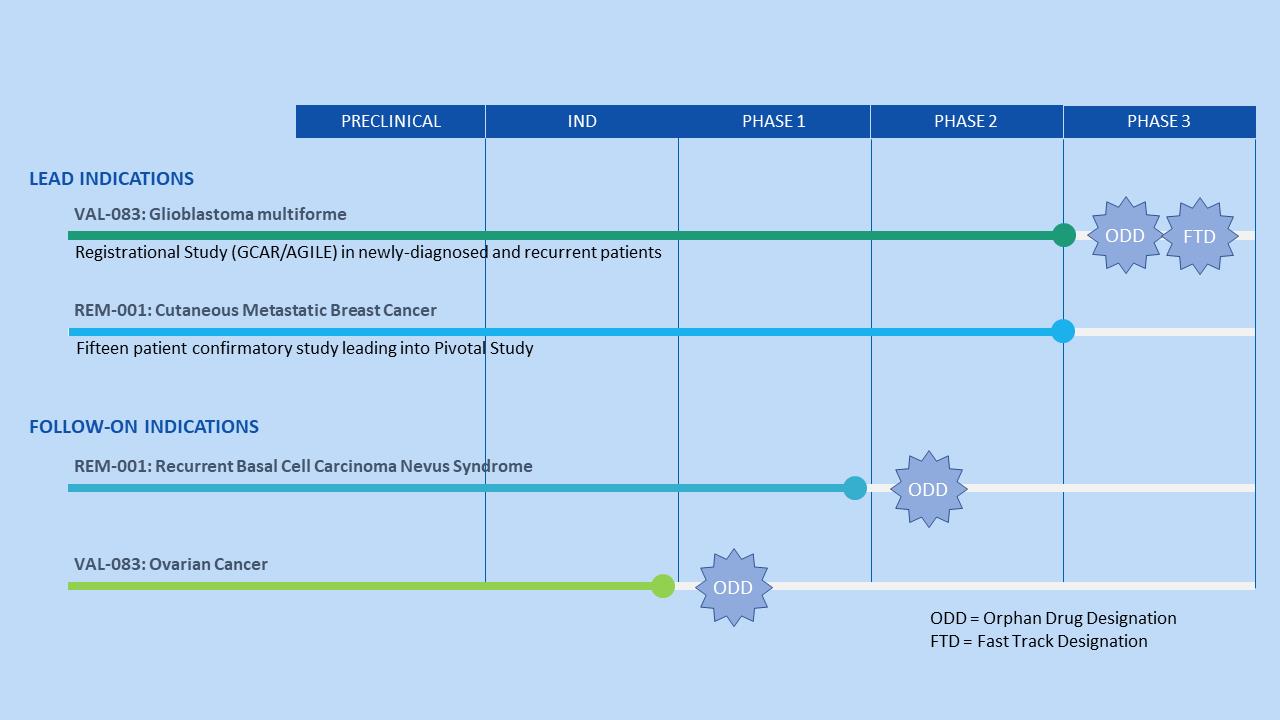

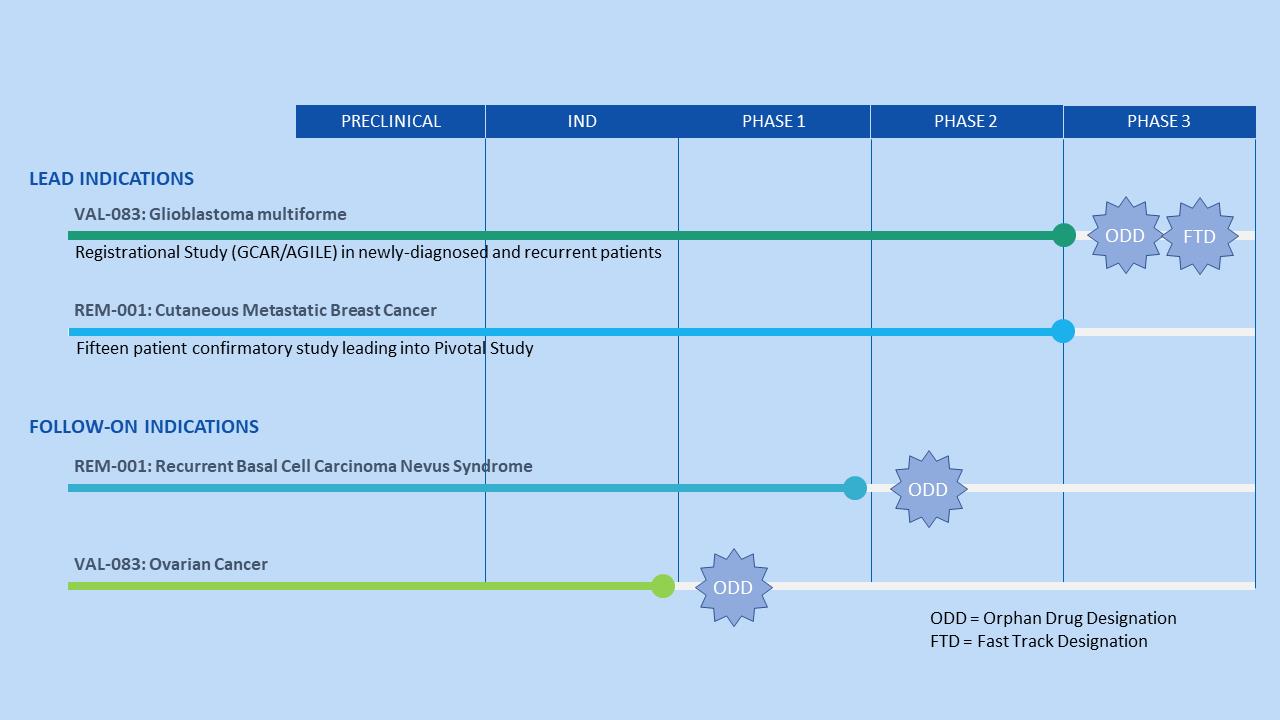

Kintara Therapeutics, Inc. (the “Company”) is a clinical stage drug development company with a focus on the development of novel cancer therapies for patients with unmet medical needs. The Company is developing two late-stage, Phase 3-ready therapeutics - VAL-083 for glioblastoma multiforme and REM-001 for cutaneous metastatic breast cancer. In order to accelerate the Company’s development timelines, it leverages existing preclinical and clinical data from a wide range of sources. The Company may seek marketing partnerships in order to potentially offset clinical costs and to generate future royalty revenue from approved indications of its product candidates.

On June 9, 2020, the Company entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), by and among Adgero Acquisition Corp., the Company’s wholly-owned subsidiary incorporated in the State of Delaware (“Merger Sub”), and Adgero Biopharmaceuticals Holdings, Inc., a Delaware corporation (“Adgero”). On August 19, 2020, upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub merged with and into Adgero (the “Merger”), the separate corporate existence of Merger Sub ceased and Adgero continued its existence under Delaware law as the surviving corporation in the Merger and became a direct, wholly-owned subsidiary of the Company. As a result of the Merger, each issued and outstanding share of Adgero common stock, par value $

Following the completion of the Merger, the Company changed its name from DelMar Pharmaceuticals, Inc. to Kintara Therapeutics, Inc. and began trading on Nasdaq under the symbol “KTRA”.

Corporate history

The Company is a Nevada corporation formed on June 24, 2009 under the name Berry Only, Inc. On January 25, 2013, the Company entered into and closed an exchange agreement (the “Exchange Agreement”), with Del Mar Pharmaceuticals (BC) Ltd. (“Del Mar (BC)”), 0959454 B.C. Ltd. (“Callco”), and 0959456 B.C. Ltd. (“Exchangeco”) and the security holders of Del Mar (BC). Upon completion of the Exchange Agreement, Del Mar (BC) became a wholly-owned subsidiary of the Company (the “Reverse Acquisition”).

Kintara Therapeutics, Inc. is the parent company of Del Mar (BC), a British Columbia, Canada corporation and Adgero, a Delaware corporation, which are clinical stage companies with a focus on the development of drugs for the treatment of cancer. The Company is also the parent company to Callco and Exchangeco which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the Reverse Acquisition. In connection with the Merger, the Company also became the parent company of Adgero Biopharmaceuticals, Inc. (“Adgero Bio”), formerly a wholly-owned subsidiary of Adgero.

References to the Company refer to the Company and its wholly-owned subsidiaries.

Going concern and management plans

These condensed consolidated interim financial statements have been prepared on a going concern basis, which assumes that the Company will continue its operations for the foreseeable future and contemplates the realization of assets and the settlement of liabilities in the normal course of business.

For the three months ended September 30, 2021, the Company reported a loss of $

7

Consequently, management is pursuing various financing alternatives to fund the Company’s operations so it can continue as a going concern. However, the coronavirus (“COVID-19”) pandemic has created significant economic uncertainty and volatility in the credit and capital markets. Management plans to secure the necessary financing through the issue of new equity and/or the entering into of strategic partnership arrangements but the ultimate impact of the COVID-19 pandemic on the Company’s ability to raise additional capital is unknown and will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak and any new information which may emerge concerning the severity of the COVID-19 pandemic. The Company may not be able to raise sufficient additional capital and may tailor its drug candidate development programs based on the amount of funding the Company is able to raise in the future. Nevertheless, there is no assurance that these initiatives will be successful.

These financial statements do not give effect to any adjustments to the amounts and classification of assets and liabilities that may be necessary should the Company be unable to continue as a going concern. Such adjustments could be material.

|

2 |

Significant accounting policies |

Basis of presentation

The condensed consolidated interim financial statements of the Company have been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”) and are presented in United States dollars. The functional currency of the Company and each of its subsidiaries is the United States dollar.

The accompanying condensed consolidated interim financial statements include the accounts of the Company and its wholly-owned subsidiaries, Adgero, Adgero Bio, Del Mar BC, Callco, and Exchangeco. All intercompany balances and transactions have been eliminated in consolidation.

The principal accounting policies applied in the preparation of these condensed consolidated interim financial statements are set out below and have been consistently applied to all periods presented.

Unaudited interim financial data

The accompanying unaudited condensed consolidated interim financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission for interim financial information. Accordingly, they do not include all of the information and the notes required by U.S. GAAP for complete financial statements. These unaudited condensed consolidated interim financial statements should be read in conjunction with the June 30, 2021 audited financial statements of the Company included in the Company’s Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on September 28, 2021. In the opinion of management, the unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of normal and recurring adjustments, necessary for a fair presentation. The results for three-months ended September 30, 2021 are not necessarily indicative of the results to be expected for the fiscal year ending June 30, 2022, or for any other future annual or interim period.

Use of estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions about future events that affect the reported amounts of assets, liabilities, expenses, contingent assets, and contingent liabilities as at the end of, or during, the reporting period. Actual results could significantly differ from those estimates. Significant areas requiring management to make estimates include the valuation of equity instruments issued for services and clinical trial accruals. Further details of the nature of these assumptions and conditions may be found in the relevant notes to these condensed consolidated interim financial statements.

Loss per share

Income or loss per share is calculated based on the weighted average number of common shares outstanding. For the three-month periods ended September 30, 2021, and 2020 diluted loss per share does not differ from basic loss per share since the effect of the Company’s warrants, stock options, and convertible preferred shares is anti-dilutive. As of September 30, 2021, potential common shares of

8

Acquired in-process research and development expense

The Company acquired in-process research and development assets in connection with its Merger with Adgero (note 3). As the acquired in-process research and development assets were deemed to have no current, or alternative future use, an expense of $

Property, equipment, and intangibles

Property, equipment and intangibles are stated at cost less accumulated depreciation. Depreciation is calculated on a straight-line basis over its estimated useful life of

Recent accounting pronouncements

During the three-months ended September 30, 2021, there have been no new, or existing recently issued, accounting pronouncements that are of significance, or potential significance, that impact the Company’s condensed consolidated interim financial statements.

|

3 |

Merger |

As described in note 1, on August 19, 2020, the Company completed its Merger with Adgero in accordance with the terms of the Merger Agreement. In connection with the Merger, substantially all of the fair value was concentrated in in-process research and development (“IPR&D”). As such, the Merger has been treated as an acquisition of Adgero assets and an assumption of Adgero liabilities.

Under the terms of the Merger Agreement, upon closing of the Merger, the Company issued

The Company incurred approximately $

In connection with the Merger, the Company recorded a milestone payment liability which relates to an asset purchase agreement with St. Cloud Investments, LLC (“St. Cloud”) that Adgero has regarding the acquisition of REM-001. The Agreement, as amended, is dated November 26, 2012 (the “St. Cloud Agreement”). Pursuant to the terms of the St. Cloud Agreement, the Company is obligated to make certain payments under the agreement. The future contingent amounts payable under that agreement are as follows:

|

|

• |

Upon the earlier of (i) a subsequent equity financing to take place after the Company conducts a Phase 2B clinical study in which fifty patients complete the study and their clinical data can be evaluated or (ii) the commencement of a clinical study intended to be used as a definitive study for market approval in any country, the Company is obligated to pay an aggregate amount of $ |

|

|

• |

Upon receipt of regulatory approval of REM-001 Therapy, the Company is obligated to pay an aggregate amount of $ |

With respect to the $300 and $700 potential milestone payments referenced above (each a “Milestone Payment”), if either such Milestone Payment becomes payable, and in the event the Company elects to pay either such Milestone Payment in shares of its common stock, the value of the common stock will equal the average of the closing price per share of the Company’s common stock over the twenty (20) trading days following the first public announcement of the applicable event described above.

9

|

|

|

$ (in thousands) |

|

|

|

Balance – June 30, 2020 |

|

|

— |

|

|

Addition |

|

|

|

|

|

Change in fair value estimate |

|

|

( |

) |

|

Balance – June 30, 2021 |

|

|

|

|

|

Change in fair value estimate |

|

|

( |

) |

|

Balance – September 30, 2021 |

|

|

|

|

|

4 |

Clinical trial deposit |

In October 2020, the Company announced that it had entered into a final agreement with a contract research organization (“CRO”) for the management of the Company’s registration study for glioblastoma multiforme. Under the agreement, the Company will supply the drug for the study and the CRO will manage all operational aspects of the study including site activation and patient enrollment. The Company is required to make certain payments under the agreement related to patient enrollment milestones. For the three months ended September 30, 2021, the Company has recognized $

In relation to this study, the Company has made a deposit payment of $

|

5 |

Property, equipment and intangibles |

|

|

|

$ (thousands) |

|

|

|

Balance, June 30, 2020 |

|

|

— |

|

|

Acquired in Adgero merger (note 3) |

|

|

|

|

|

Laboratory equipment purchased |

|

|

|

|

|

Disposal of furniture |

|

|

( |

) |

|

Property, equipment and intangibles |

|

|

|

|

|

Less accumulated depreciation |

|

|

( |

) |

|

Balance, June 30, 2021 |

|

|

|

|

|

Less accumulated depreciation |

|

|

( |

) |

|

Balance, September 30, 2021 |

|

|

|

|

|

6 |

Related party transactions |

Valent Technologies, LLC Agreements

One of the Company’s officers is a principal of Valent Technologies, LLC (“Valent”) and as result Valent is a related party to the Company.

On September 12, 2010, the Company entered into a Patent Assignment Agreement (the “Valent Assignment Agreement”) with Valent pursuant to which Valent transferred to the Company all its right, title and interest in, and to, the patents for VAL-083 owned by Valent. The Company now owns all rights and title to VAL-083 and is responsible for further development and commercialization. In accordance with the terms of the Valent Assignment Agreement, Valent is entitled to receive a future royalty on all revenues derived from the development and commercialization of VAL-083. In the event that the Company terminates the agreement, the Company may be entitled to receive royalties from Valent’s subsequent development of VAL-083 depending on the development milestones the Company has achieved prior to the termination of the Valent Assignment Agreement.

On September 30, 2014, the Company entered into an exchange agreement (the “Valent Exchange Agreement”) with Valent and Del Mar (BC). Pursuant to the Valent Exchange Agreement, Valent exchanged its loan payable in the outstanding amount of $

10

the Company recorded $

Related party payables

At September 30, 2021 there is an aggregate amount of $

|

7 |

Stockholders’ equity |

Preferred stock

Series C Preferred Stock

|

|

|

Series C Preferred Stock |

|

|||||

|

|

|

Number of shares |

|

|

$ (in thousands) |

|

||

|

Balance – June 30, 2020 |

|

|

— |

|

|

|

— |

|

|

Issuance |

|

|

|

|

|

|

|

|

|

Issued on exercise of Series C Agent Warrants |

|

|

|

|

|

|

|

|

|

Conversion of Series C Preferred stock to common stock |

|

|

( |

) |

|

|

( |

) |

|

Balance – June 30, 2021 |

|

|

|

|

|

|

|

|

|

Conversion of Series C Preferred stock to common stock |

|

|

( |

) |

|

|

( |

) |

|

Balance – September 30, 2021 |

|

|

|

|

|

|

|

|

In connection with the Merger (note 3), in August 2020, the Company issued

The Series C Preferred Stock dividends do not require declaration by the Board of Directors and are accrued annually as of the date the dividend is earned in an amount equal to fair value of the Company’s common stock on the dates the respective dividends are paid. The fair value of the Series C Preferred Stock dividend paid on August 19, 2021, was determined by multiplying the dividends paid of

Total gross proceeds from the private placement were $

The Company’s Series C Preferred Stock outstanding, conversion shares, and dividends as of September 30, 2021, are as follows:

|

Series |

|

Number |

|

|

Conversion price $ |

|

|

Number of conversion shares (in thousands) |

|

|

Dividend Shares (in thousands) |

|

||||

|

Series 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

Series C Dividends |

|

Dividend Shares (in thousands) |

|

|

|

10% - August 19, 2021 (actual) |

|

|

|

|

|

15% - August 19, 2022 (estimated) |

|

|

|

|

|

20% - August 19, 2023 (estimated) |

|

|

|

|

|

25% - August 19, 2024 (estimated) |

|

|

|

|

|

|

|

|

|

|

The conversion feature of the Series C Convertible Preferred Stock at the time of issuance was determined to be beneficial on the commitment date. Because the Series C Convertible Preferred Stock was perpetual with no stated maturity date, and the conversions could occur any time from inception, the Company immediately recorded a non-cash deemed dividend of $

The Series C Preferred Stock shall with respect to distributions of assets and rights upon the occurrence of a liquidation, rank (i) senior to the Company’s common stock and (ii) senior to any other class or series of capital stock of the Company hereafter created which does not expressly rank pari passu with, or senior to, the Series C Preferred Stock. The Series C Preferred Stock shall be pari passu in liquidation to the Company’s Series A Preferred Stock. The liquidation value of the Series C Preferred Stock at September 30, 2021, is the stated value of $

Series B Preferred Stock

During the year ended June 30, 2016, the Company issued

In addition, the Company and the Series B Preferred Stock holders entered into a royalty agreement, pursuant to which the Company will pay the holders of the Series B Preferred Stock, in aggregate, a low, single-digit royalty based on their pro rata ownership of the Series B Preferred Stock on products sold directly by the Company or sold pursuant to a licensing or partnering arrangement.

Series A Preferred Stock

Effective September 30, 2014, the Company filed a Certificate of Designation of Series A Preferred Stock (the “Series A Certificate of Designation”) with the Secretary of State of Nevada. Pursuant to the Series A Certificate of Designation, the Company designated

The Series A Preferred Stock shall with respect to distributions of assets and rights upon the occurrence of a liquidation, rank (i) senior to the Company’s common stock, and (ii) senior to any other class or series of capital stock of the Company hereafter created which does not expressly rank pari passu with, or senior to, the Series A Preferred Stock. The Series A Preferred Stock shall be pari passu in liquidation to the Company’s Series C Preferred Stock. The liquidation value of the Series A Preferred stock at September 30, 2021 is its stated value of $

There was

12

Common stock

Stock issuances during the three months ended September 30, 2021

Registered direct financing

On September 28, 2021,

The net proceeds from the Offering, were $

The 2022 Investor Warrants are exercisable at $1.25 per share until their expiry on

During the three months ended September 30, 2021, all of the

Stock options

2017 Omnibus Incentive Plan

As subsequently approved by the Company’s stockholders at an annual meeting of stockholders on April 11, 2018, the Company’s board of directors approved adoption of the Company’s 2017 Omnibus Equity Incentive Plan (the “2017 Plan”). The board of directors also approved a form of Performance Stock Unit Award Agreement to be used in connection with grants of performance stock units (“PSUs”) under the 2017 Plan. As approved by the Company’s stockholders on June 25, 2021, the number of common shares available under the 2017 Plan was increased to

The maximum number of shares of Company common stock with respect to which any one participant may be granted awards during any calendar year is

During the three-months ended September 30, 2021, a total of

13

The following table sets forth changes in stock options outstanding under all plans:

|

|

|

Number of stock options outstanding (in thousands) |

|

|

Weighted average exercise price |

|

||

|

Balance – June 30, 2021 |

|

|

|

|

|

|

|

|

|

Granted |

|

|

|

|

|

|

|

|

|

Expired |

|

|

( |

) |

|

|

|

|

|

Balance – September 30, 2021 |

|

|

|

|

|

|

|

|

The following table summarizes stock options outstanding and exercisable under all plans at September 30, 2021:

|

Exercise price $ |

|

|

Number Outstanding at September 30, 2021 (in thousands) |

|

|

Weighted average remaining contractual life (years) |

|

|

Number exercisable at September 30, 2021 (in thousands) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Included in the number of stock options outstanding are

|

|

|

September 30, 2021 |

|

|

|

|

Dividend rate |

|

|

— |

|

% |

|

Estimated volatility |

|

|

|

% |

|

|

Risk-free rate |

|

|

|

% |

|

|

Expected term – years |

|

|

|

|

|

The estimated volatility of the Company’s common stock at the date of issuance of the stock options is based on the historical volatility of the Company. The risk-free interest rate is based on rates published by the government for bonds with a maturity similar to the expected remaining term of the stock options at the valuation date. The expected term of the stock options has been estimated using the plain vanilla method.

14

The Company has recognized the following amounts as stock option expense for the periods noted (in thousands):

|

|

|

Three months ended September 30, |

|

|||||

|

|

|

2021 $ |

|

|

2020 $ |

|

||

|

Research and development |

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All of the stock option expense for the periods ended September 30, 2021, and 2020 has been recognized as additional paid in capital. The aggregate intrinsic value of stock options outstanding at September 30, 2021 was $

The following table sets forth changes in unvested stock options under all plans:

|

|

|

Number of Options (in thousands) |

|

|

Weighted average exercise price $ |

|

||

|

Unvested at June 30, 2021 |

|

|

|

|

|

|

|

|

|

Granted |

|

|

|

|

|

|

|

|

|

Vested |

|

|

( |

) |

|

|

|

|

|

Unvested at September 30, 2021 |

|

|

|

|

|

|

|

|

The aggregate intrinsic value of unvested stock options at September 30, 2021 was $

Common stock warrants

The following table sets forth changes in outstanding common stock warrants:

|

|

|

Number of Warrants (in thousands) |

|

|

Weighted average exercise price $ |

|

||

|

Balance – June 30, 2021 |

|

|

|

|

|

|

|

|

|

Issuance of 2022 Investor Warrants |

|

|

|

|

|

|

|

|

|

Issuance of PFW |

|

|

|

|

|

|

|

|

|

Issuance of 2022 Agent Warrants |

|

|

|

|

|

|

|

|

|

Exercise of PFW |

|

|

( |

) |

|

|

|

|

|

Exercise of 2020 Investor Warrants |

|

|

( |

) |

|

|

|

|

|

Expiry of Adgero replacement warrants |

|

|

( |

) |

|

|

|

|

|

Balance – September 30, 2021 |

|

|

|

|

|

|

|

|

15

The following table summarizes the Company’s outstanding common stock warrants as of September 30, 2021:

|

Description of warrants |

|

Number (in thousands) |

|

|

Exercise price $ |

|

|

Expiry date |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 Investor warrants |

|

|

|

|

|

|

|

|

|

|

|

2020 Investor warrants |

|

|

|

|

|

|

|

|

|

|

|

2019 Investor warrants |

|

|

|

|

|

|

|

|

|

|

|

2018 Investor warrants |

|

|

|

|

|

|

|

|

|

|

|

2017 Investor warrants |

|

|

|

|

|

|

|

|

|

|

|

NBTS Warrants |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

Warrants issued for services |

|

|

|

|

|

|

|

|

|

|

|

2022 Agent warrants |

|

|

|

|

|

|

|

|

|

|

|

2019 Agent warrants |

|

|

|

|

|

|

|

|

|

|

|

2018 Agent warrants |

|

|

|

|

|

|

|

|

|

|

|

2017 Agent warrants |

|

|

|

|

|

|

|

|

|

|

|

Adgero Warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series C Preferred Stock warrants

In connection with the Series C Preferred Stock private placement, the Company issued

The Series C Agent Warrants were valued at a total of $

The following table sets forth changes in outstanding Series C Agent Warrants:

|

|

|

Balance June 30, 2021 |

|

|

Number of Warrants Issued |

|

|

Number of Warrants Exercised |

|

|

Balance, September 30, 2021 |

|

|

Conversion price $ |

|

|||||

|

Issuance of Preferred Series C-1 Agent Warrants |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of Preferred Series C-2 Agent Warrants |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Issuance of Preferred Series C-3 Agent Warrants |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

16

The following table summarizes the Company’s outstanding Series C Agent Warrants as of September 30, 2021:

|

Series C Agent Warrants |

|

Number |

|

|

Conversion price $ |

|

|

Number of conversion shares (in thousands) |

|

|

Cumulative common stock dividends (in thousands) |

|

||||

|

Series 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Supplementary statement of cash flows information |

The Company incurred the following non-cash investing and financing transactions (in thousands):

|

|

|

Three months ended |

|

|||||

|

|

|

September 30, 2021 $ |

|

|

September 30, 2020 $ |

|

||

|

Series C Preferred Stock common stock dividend (note 7) |

|

|

|

|

|

|

— |

|

|

Series B Preferred Stock common stock dividend (note 7) |

|

|

— |

|

|

|

|

|

|

Deemed dividend recognized on beneficial conversion features of Series C Preferred stock issuance (note 7) |

|

|

— |

|

|

|

|

|

|

Non-cash issue costs (note 7) |

|

|

|

|

|

|

|

|

|

Issue costs in accounts payable and accrued liabilities |

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

|

— |

|

|

|

— |

|

|

Interest paid |

|

|

— |

|

|

|

— |

|

|

9 |

Financial instruments |

The Company has financial instruments that are measured at fair value. To determine the fair value, the Company uses the fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use to value an asset or liability and are developed based on market data obtained from independent sources. Unobservable inputs are inputs based on assumptions about the factors market participants would use to value an asset or liability. The three levels of inputs that may be used to measure fair value are as follows:

|

|

• |

Level one - inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities; |

|

|

• |

Level two - inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals; and |

|

|

• |

Level three - unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use. |

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. Changes in the observability of valuation inputs may result in a reclassification of levels for certain securities within the fair value hierarchy.

|

|

|

September 30, 2021 |

|

|||||||||

|

Liability |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|||

|

Milestone payment liability |

|

|

— |

|

|

|

— |

|

|

|

|

|

The Company’s financial instruments consist of cash and cash equivalents, other receivables, accounts payable, and related party payables. The carrying values of cash and cash equivalents, other receivables, accounts payable and related party payables approximate their fair values due to the immediate or short-term maturity of these financial instruments.

17

|

10 |

Subsequent events |

Series C Preferred Stock

Subsequent to September 30, 2021,

Stock options

On November 8, 2021, the Company issued

The Company has evaluated its subsequent events from September 30, 2021, through the date these condensed consolidated interim financial statements were issued and has determined that there are no subsequent events requiring disclosure in these condensed consolidated interim financial statements other than the items noted above.

18

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Management’s Discussion and Analysis (“MD&A”) contains “forward-looking statements”, within the meaning of the Private Securities Litigation Reform Act of 1995, which represent our projections, estimates, expectations, or beliefs concerning, among other things, financial items that relate to management’s future plans or objectives or to our future economic and financial performance. In some cases, you can identify these statements by terminology such as “may”, “should”, “plans”, “believe”, “will”, “anticipate”, “estimate”, “expect” “project”, or “intend”, including their opposites or similar phrases or expressions. You should be aware that these statements are projections or estimates as to future events and are subject to a number of factors that may tend to influence the accuracy of the statements. These forward-looking statements should not be regarded as a representation by us or any other person that our events or plans will be achieved. You should not unduly rely on these forward-looking statements, which speak only as of the date of this report. Except as may be required under applicable securities laws, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this report or to reflect the occurrence of unanticipated events.

You should review the factors and risks we describe under “Risk Factors” in our report on Form 10-K for the year ended June 30, 2021 and in our other filings with the Securities and Exchange Commission, available at www.sec.gov. Actual results may differ materially from any forward-looking statement.

Impact of Coronavirus (“COVID-19”) on our Operations, Financial Condition, Liquidity and Results of Operations

In December 2019, a novel strain of coronavirus, COVID-19, was reported to have surfaced in Wuhan, China and on March 11, 2020 it was declared a pandemic by the World Health Organization. The ultimate impact of the COVID-19 pandemic on our operations is unknown and will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak, new information which may emerge concerning the duration and severity of the COVID-19 pandemic, and any additional preventative and protective actions that governments, or us, may determine are needed.

The COVID-19 pandemic did not cause significant disruption to our Phase 2 clinical studies. Each of our now-completed Phase 2 clinical studies was conducted at respective single sites which reduced the risk of study disruption. Any disruptions to patient treatments for our Phase 2 studies were within allowances under each study protocol. Access to the sites by our clinical monitors was limited during the COVID-19 pandemic but the recording of study data in both studies and patient treatments at both study sites was conducted per protocol.

Regarding the VAL-083 study arm of the GCAR registrational Phase 2/3 clinical trial that is currently being conducted at multiple sites in the United States, we have not experienced any significant impacts on patient enrollment or treatment. With respect to the REM-001 drug supply, we are currently experiencing some delays in contract manufacturing schedules and supplies which we attribute to COVID-19. The current delays could have an impact on our REM-001 program timeline.

Including net proceeds of approximately $13.6 million received from a registered direct financing that closed on September 28, 2021, we estimate that we have cash available to fund planned operations for less than one year from the date of issuance of our September 30, 2021 condensed consolidated interim financial statements but cash is expected to fund planned operations through stage 1 of the GBM AGILE study, which could result in graduation to the final confirmatory stage, the potential NDA enabling portion of the study. However, the COVID-19 pandemic has created significant economic uncertainty and volatility in the credit and capital markets. The ultimate impact of the COVID-19 pandemic on our ability to raise additional capital is unknown and will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak and new information which may emerge concerning the severity of the COVID-19 pandemic. We may not be able to raise sufficient additional capital and may tailor our drug candidate development programs based on the amount of funding we are able to raise in the future. Nevertheless, there is no assurance that these initiatives will be successful.

Background

Kintara Therapeutics, Inc. is a clinical stage, biopharmaceutical company focused on the development and commercialization of new cancer therapies.

19

On June 10, 2020, we entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) dated as of June 9, 2020, by and among Adgero Acquisition Corp., our wholly-owned subsidiary incorporated in the State of Delaware (“Merger Sub”), and Adgero Biopharmaceuticals Holdings, Inc., a Delaware corporation (“Adgero”). On August 19, 2020, upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub merged with and into Adgero (the “Merger”), the separate corporate existence of Merger Sub ceased, and Adgero continued its existence under Delaware law as the surviving corporation in the Merger and became our direct, wholly-owned subsidiary. As a result of the Merger, each issued and outstanding share of Adgero common stock, par value $0.0001 per share (the “Adgero Common Stock”) (other than treasury shares held by Adgero), was converted automatically into the right to receive 1.5740 shares (the “Exchange Ratio”) of our common stock, and cash in lieu of any fractional shares. Also, each outstanding warrant to purchase Adgero Common Stock was converted into a warrant exercisable for that number of shares of our common stock equal to the product of (x) the aggregate number of shares of Adgero Common Stock for which such warrant was exercisable and (y) the Exchange Ratio.

Following the completion of the Merger, we changed our name from DelMar Pharmaceuticals, Inc. to Kintara Therapeutics, Inc. and began trading on Nasdaq under the symbol “KTRA”.

We are the parent company of Del Mar (BC), a British Columbia, Canada corporation, and Adgero. We are also the parent company to Callco and Exchangeco which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the Reverse Acquisition that occurred in 2013.

References to “we”, “us”, and “our”, refer to Kintara and our wholly-owned subsidiaries, Del Mar (BC), Adgero, Adgero Bio, Callco, and Exchangeco.

We are dedicated to the development of novel cancer therapies for patients with unmet medical needs. Our mission is to benefit patients by developing and commercializing anti-cancer therapies for patients whose solid tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies, with particular focus on orphan cancer indications.

Our two lead candidates are VAL-083, a novel, validated, DNA-targeting agent, for the treatment of drug-resistant solid tumors such as glioblastoma multiforme (“GBM”) and potentially other solid tumors, including ovarian cancer, non-small cell lung cancer (“NSCLC”), and diffuse intrinsic pontine glioma (“DIPG”) and REM-001, a late-stage photodynamic therapy (“PDT”) for the treatment of cutaneous metastatic breast cancer (“CMBC”). PDT is a treatment that uses light sensitive compounds, or photosensitizers, that, when exposed to specific wavelengths of light, act as a catalyst to produce a form of oxygen that induces local tumor cell death.

Recent Highlights

|

|

• |

On November 8, 2021, we positioned our management team for our next stage of development by announcing that Robert E. Hoffman, our current Chairman, will succeed Saiid Zarrabian as President and Chief Executive Officer. Mr. Hoffman will continue in his capacity as our Chairman and Mr. Zarrabian will transition to heading up our strategic partnerships initiative and will remain a member of the Board of Directors. |

|

|

• |

On September 23, 2021, we entered into securities purchase agreements with certain institutional investors pursuant to which, on September 28, 2021, we issued an aggregate of 7,200,000 shares of common stock, pre-funded warrants to purchase 4,800,000 shares of common stock and warrants to purchase 12,000,000 shares of common stock for approximately $15 million in gross proceeds, before placement agent fees and other offering expenses payable by us. The warrants have an exercise price of $1.25 per share and expire on March 28, 2025. We estimate that the financing will provide sufficient funding through stage 1 of our Global Coalition for Adaptive Research (“GCAR”) registrational Phase 2/3 clinical study for GBM, which could result in graduation to the final confirmatory stage, the potentially NDA enabling portion of this study. |

|

|

• |

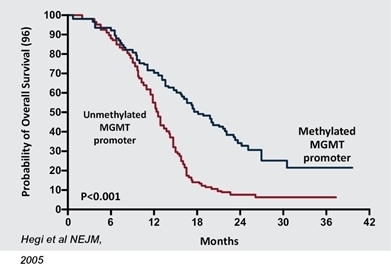

On September 22, 2021, we reported positive topline data for the adjuvant arm of our open-label, Phase 2 clinical study of our lead compound, VAL-083, that was conducted at the MD Anderson Cancer Center (“MD Anderson”) in Houston, Texas. The Phase 2 study was a two-arm, biomarker-driven study testing VAL-083 in GBM patients who have an unmethylated promoter of the methylguanine DNA-methyltransferase (“MGMT”) gene. The adjuvant arm of the study investigated newly-diagnosed patients suffering from GBM receiving VAL-083 in place of standard-of-care temozolomide (“TMZ”) as adjuvant therapy following surgery and chemoradiation TMZ. |

|

|

• |

On August 17, 2021, we announced that 26 clinical sites in the United States had been activated for our GCAR registrational Phase 2/3 clinical study for GBM. The study, titled GBM AGILE (Glioblastoma Adaptive Global Innovative Learning Environment) Study, is a revolutionary, patient-centered, adaptive platform study for registration evaluating multiple therapies for patients with newly-diagnosed and recurrent GBM. |

20

Targeted Clinical Milestones

(calendar quarters)

Below are our planned, or expected, milestones for the respective time periods noted:

Q1 2022

|

|

• |

REM-001: reactivation of Investigational New Drug application |

Q2 2022

|

|

• |

REM-001: enroll first patient – CMBC fifteen patient confirmatory study leading into pivotal study |

Q3 2022

|

|

• |

VAL-083: GCAR GBM AGILE registration study graduation from stage 1 (safety and efficacy: 100-150 patients) to stage 2 (confirmatory: 50 additional patients) |

Product Pipeline

VAL-083

Background