UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1 /A

(Amendment No. 1)

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

BERRY ONLY INC.

(Name of small business issuer in its charter)

|

Nevada

|

|

2842

|

|

99-0360497

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

722B Kingston Rd, Toronto, Ontario, M4E 1R7, Canada

(647) 283-3152

(Address and telephone number of principal executive offices)

722B Kingston Rd, Toronto, Ontario, M4E 1R7, Canada

(Address of principal place of business or intended place of business)

Nevada Agency and Trust Company

50 West Liberty Street, Suite 880, Reno, Nevada 89501

(775) 322-0626

(Name, address and telephone number of agent for service)

With copies to:

Karen A. Batcher, Esq

Synergen Law Group, APC

819 Anchorage Place, Suite 28

Chula Vista, CA 91914

Tel: (619) 475-7882

Fax: (619) 512-5184

Approximate date of commencement of proposed sale to public:

As soon as practical after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities At registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, and accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated Filer o Non-accelerated filer o Smaller Reporting Company x

CALCULATION OF REGISTRATION FEE

|

TITLE OF EACH

CLASS OF SECURITIES

TO BE REGISTERED

|

|

AMOUNT TO BE

REGISTERED

|

|

PROPOSED MAXIMUM OFFERING

PRICE PER

SHARE (1)

|

|

|

PROPOSED MAXIMUM AGGREGATE OFFERING

PRICE (1)

|

|

|

AMOUNT OF REGISTRATION FEE (1)

|

|

|

Common Stock

|

|

2,950,000 shares

|

|

$ |

0.01 |

|

|

$ |

29,500 |

|

|

$ |

2.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE RERGISTRATION SHALL BECOME EFFECTIVE ON SUCH A DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION, Dated September 22, 2010

PROSPECTUS

BERRY ONLY INC.

2,950,000 SHARES

COMMON STOCK

The selling shareholders named in this prospectus are offering the 2,950,000 shares of our common stock offered through this prospectus. The 2,950,000 shares offered by the selling shareholders represent 49.58% of the total outstanding shares as of the date of this prospectus. We will not receive any proceeds from this offering. We have set an offering price for these securities of $0.01 per share of our common stock offered through this prospectus.

| |

|

Offering Price

|

|

Underwriting

Discounts and

Commissions

|

|

Proceeds to Selling Shareholders

|

|

|

Per Share

|

|

$ |

0.01 |

|

None

|

|

$ |

0.01 |

|

|

Total

|

|

$ |

29,500 |

|

None

|

|

$ |

29,500 |

|

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at 0.01 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our common stock on the NASD Over-The-Counter Bulletin Board electronic quotation service, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board electronic quotation service, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled “Risk Factors” on page 4.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: September 22, 2010

As used in this prospectus, unless the context otherwise requires, “we”, “us”, “our” or “Berry Only” refers to Berry Only Inc. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. The following summary is not complete and does not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision to purchase our common shares.

Berry Only Inc.

Berry Only Inc. was incorporated in the State of Nevada as a development stage company corporation which recently signed a milestone agreement with the U.S. manufacturer of Wireless Wipes™ to acquire the exclusive rights to distribute the product in Canada. Wireless Wipes™ is a new, unique, first to market sanitizer designed specifically to clean mobile phones, PDA’s (personal digital assistants) and laptop computer screens. They are fast drying to prevent moisture damage, non-streaking and non-corrosive with a pleasant green tea-cucumber scent. Wireless Wipes™ are packaged in 10-count re-sealable pouches which can fit neatly in a shirt or jacket pocket. We are still in our development stage and plan on commencing business operations in winter 2010.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we have completed our website and are able to accept orders. As of June 30, 2010, we had $44,561 cash on hand and $652 liabilities. Accordingly our working capital position as of June 30, 2010 was $43,909. Since our inception through June 30, 2010, we have incurred a net loss of $5,582. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business.

John Kinross-Kennedy, C.P.A., our independent auditor, has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact to date have had no revenues.

Our fiscal year ended is June 30.

We were incorporated on June 24, 2009 under the laws of the State of Nevada. Our principal offices are located at 722B Kingston Rd, Toronto, Ontario, Canada. Our telephone number is (647) 283-3152.

The Offering

|

Securities Being Offered

|

Up to 2,950,000 shares of our common stock.

|

| |

|

|

Offering Price

|

The offering price of the common stock is $0.01 per share. We intend to apply to the NASD Over-the-Counter Bulletin Board electronic quotation service to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transaction negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

|

|

Minimum Number of Shares

|

None

|

|

To Be Sold in This Offering

|

|

| |

|

|

Securities Issued

and to be Issued

|

5,950,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders and thus there will be no increase in our issued and outstanding shares as a result of this offering. The issuance to the selling shareholders was exempt due to the provisions of Regulation S.

|

| |

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the common stock by the selling shareholders.

|

Summary Financial Information

|

Balance Sheet Data

|

|

June 30, 2010 (audited)

|

|

|

Cash

|

|

$ |

44,561 |

|

|

Total Current Assets

|

|

$ |

44,561 |

|

|

Liabilities

|

|

$ |

652 |

|

|

Total Stockholder’s Equity

|

|

$ |

43,909 |

|

|

Statement of Loss and Deficit

|

|

From Inception (June 24, 2009)

to June 30, 2010 (audited)

|

|

|

June 30, 2010 (audited)

|

|

|

|

|

Revenue

|

|

$ |

- |

|

|

Net Loss for the Period

|

|

$ |

5,582 |

|

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, we will not be able to conduct our business operations to the extent that we become profitable.

Our current operating funds will cover the initial stages of our business plan; however, we currently do not have any operations and we have no income. Because of this and the fact that we will incur significant legal and accounting

costs necessary to maintain a public corporation, we will require additional financing to complete our development activities. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. We believe the only source of funds that would be realistic is through a loan from our president and the sale of equity capital.

Our Independent Auditor has indicated that he has substantial doubt about our ability to continue as a going concern, if true, you could lose your investment.

John Kinross-Kennedy, C.P.A., our independent auditor, has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact to date have had no revenues. Potential investors should be aware that there are difficulties associated with being a new venture, and the high rate of failure associated with this fact. We have incurred a net loss of $5,582 for the period from June 24, 2009 (inception) to June 30, 2010 and have had no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from our website. These factors raise substantial doubt that we will be able to continue as a going concern.

Our financial statements included with this prospectus have been prepared assuming that we will continue as a going concern. Our auditor has made reference to the substantial doubt as to our ability to continue as a going concern in his audit report on our audited financial statements for the year ended June 30, 2010. If we are not able to achieve revenues, then we may not be able to continue as a going concern and our financial condition and business prospects will be adversely affected.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our development stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from our business development, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because we have obligations under the Exclusive Distribution Agreement with Wireless Wipes™, we may not be able to meet those obligations, causing our business to fail

According to the Exclusive Distribution Agreement with Wireless Wipes™, annual distribution of a minimum of 10,000 pouches is expected or the agreement becomes null and void. We have until June 30, 2011 to reach this annual distribution minimum. If we were to lose the exclusive distribution rights our business will most likely fail.

Because our president has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Because we are in the development stage of our business, Mr. Guest will not be spending a significant amount of time on our business. Mr. Guest expects to expend approximately 20 hours per week on our business. Competing demands on Mr. Guest's time may lead to a divergence between his interests and the interests of other shareholders. Mr. Guest is a corporate real estate executive and divides his time amongst various projects. None of the work he will be undertaking as a corporate real estate executive will directly compete with Berry Only Inc.

Because our president owns approximately 50.42% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Guest are inconsistent with the best interests of other stockholders

Mr. Guest is our president and sole director. He owns approximately 50.42% of the outstanding shares of our common stock as of the date of this prospectus. Accordingly, he has, and following the completion of the offering, will continue to have sole power in deciding every aspect of our business. Mr. Guest has the sole power in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. Guest may still differ from the interests of other stockholders. Mr. Guest owns 3,000,000 common shares for which he paid $0.005 per share for 2,000,000 common shares and $0.01 per share for 1,000,000 common shares.

Because our President and sole director is a Canadian Resident, difficulty may arise in attempting to effect service or process on him in Canada

Because Mr. Guest our sole director and officer, is a Canadian resident, difficulty may arise in attempting to effect service or process on him in Canada or in enforcing a judgment against Berry Only Inc.’s assets located outside of the United States.

The success of our business depends on the continued use and growth of the Internet as a commerce platform

The existence and growth of our service depends on the continued acceptance of the Internet as a commerce platform for individuals and enterprises. The internet could possibly lose its viability as a tool to pay for online services by the adoption of new standards and protocols to handle increased demands of Internet activity, security, reliability, cost, ease-of-use, accessibility and quality of service. The acceptance and performance of the Internet has been harmed by “viruses,” “worms,” and “spy-ware”. If for some reason the Internet was no longer widely accepted as a tool to pay for online services, the demand for our service would be significantly reduced, which would harm or cause our business to fail.

Because we will rely on a third-party for hosting and maintenance of our website, mismanagement or service interruptions could significantly harm our business

Our website will be hosted and maintained by a third party hosting service. Any mismanagement, service interruptions, or damage to the data of our company or our customers, could result in the loss of customers, or other harm to our business.

Evolving regulation of the Internet may adversely affect us

As Internet commerce continues to evolve there may be increased regulation by federal, state and/or foreign agencies. Any new regulations which restrict us from being able to accept all of the various forms of online payment available today, could harm or cause our business to fail.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares

There is currently no market for our common stock and a market may never develop. We currently plan to apply for listing of our common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, a public market may never materialize. If our common stock is not traded on the Over-the-Counter Bulletin Board electronic quotation service or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If a market for our common stock develops, our stock price may be volatile

If a market for our common stock develops, we anticipate that the market price of our common stock will be subject to wide fluctuations in response to several factors, including:

|

●

|

the evolving demand for our service;

|

|

●

|

our ability or inability to arrange for financing;

|

|

●

|

our ability to manage expenses;

|

|

●

|

changes in our pricing policies or our competitors; and

|

|

●

|

global economic and political conditions.

|

Further, if our common stock is traded on the Over-the-Counter Bulletin Board electronic quotation service, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations may adversely affect the market price of our common stock.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline

The selling shareholders are offering 2,950,000 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock

The shares offered by this prospectus constitute a penny stock under the Securities and Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. Penny stocks generally are equity securities with a price of less than $5.00. Broker/dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. The penny stock rules require a broker/dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the Securities and Exchange Commission that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker/dealer, and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules: the broker/dealer must make a special written determination that a penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of price fluctuations in the price of the stock and may reduce the level of trading activity in any secondary market for a stock that becomes subject to the penny stock rules, and accordingly, investors in this offering may find it difficult to sell their securities, if at all.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

The $0.01 per share offering price of our common stock was determined arbitrarily by us. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value. We intend to apply to the Over-the-Counter Bulletin Board electronic quotation service for the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange Act”). If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders named in this prospectus.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

The selling shareholders named in this prospectus are offering all of the 2,950,000 shares of common stock offered through this prospectus. The selling shareholders acquired the 2,950,000 shares of common stock offered through this prospectus from us at a price of $0.01 per share in an offering that was exempt from registration under Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) and completed on June 30, 2010. We will file with the Securities and Exchange Commission prospectus supplements to specify the names of any successors to the selling shareholders specified in this registration statement who are able to use the prospectus included in this registration statement to resell the shares registered by this registration statement.

The following table provides, as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

|

1.

|

The number of shares owned by each prior to this offering;

|

|

2.

|

The total number of shares that are to be offered by each;

|

|

3.

|

The total number of shares that will be owned by each upon completion of the offering;

|

|

4.

|

The percentage owned by each upon completion of the offering; and

|

|

5.

|

The identity of the beneficial holder of any entity that owns the shares.

|

|

Name Of Selling Stockholder

|

|

Shares

Owned Prior

to this

Offering

|

|

Total Number

of Shares to Be

Offered for Selling

Shareholder

Account

|

|

Total Shares

to be Owned

Upon

Completion of this

Offering

|

|

Percent

Owned Upon

Completion of this

Offering

|

|

Brenda Aines

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Tim Brooks

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Monique Chelsom

|

|

150,000

|

|

150,000

|

|

Nil

|

|

Nil

|

|

Krisanne Dierijck

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Margaret Doell

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Bill Evans

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Elizabeth Evans

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Kevin Evans

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Leonard Evans

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Wade Evans

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Iryna Gel

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Bradley Gingerich

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Kim Gingerich

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Donna Halendy

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Troy Hannon

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Roy Hayter

|

|

150,000

|

|

150,000

|

|

Nil

|

|

Nil

|

|

Sandra Hayter

|

|

150,000

|

|

150,000

|

|

Nil

|

|

Nil

|

|

Andrea Kroeger

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Sergiy Litvinov

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Yuriy Litvinov

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Ken Mischki

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Cathy Miyauchi

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Jenny O’Donnel

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Mike Pedersen

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Lena Ross

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Wesley Sabulka

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Conny Sarvari

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Yuriy Synenko

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Lisa Thompson

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Brandon Tyers

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Cherie Tyers

|

|

100,000

|

|

100,000

|

|

Nil

|

|

Nil

|

|

Deborah Whitton

|

|

150,000

|

|

150,000

|

|

Nil

|

|

Nil

|

|

Si Xing

|

|

50,000

|

|

50,000

|

|

Nil

|

|

Nil

|

|

Total

|

|

2,950,000

|

|

2,950,000

|

|

Nil

|

|

Nil

|

The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold.

None of the selling shareholders:

|

(1)

|

has had a material relationship with us other than as a shareholder at any time within the past three years; or

|

|

(2)

|

has ever been one of our officers or directors.

|

Prior to each sale of shares to the Selling Shareholders, each Selling Shareholder represented in writing to the Company that the Shares would be purchased solely for the account of the shareholder and not with a view to, or for resale in connection with, any distribution in any jurisdiction where such sale or distribution would be precluded. Accordingly, the Company believes that each Selling Shareholder purchased the Shares to be resold in the ordinary course of business, and did not have any agreements or understandings, directly nor indirectly, with any person to distribute the securities after purchase.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

|

1.

|

On such public markets as the common stock may from time to time be trading;

|

|

2.

|

In privately negotiated transactions;

|

|

3.

|

Through the writing of options on the common stock;

|

|

4.

|

In short sales; or

|

|

5.

|

In any combination of these methods of distribution.

|

The sales price to the public is fixed at $0.01 per share until such time as the shares of our common stock are traded on the Over-the-Counter Bulletin Board electronic quotation service. Although we intend to apply for trading of our common stock on the Over-the-Counter Bulletin Board electronic quotation service, public trading of our common stock may never materialize. If our common stock becomes traded on the Over-the-Counter Bulletin Board electronic quotation service, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

|

1.

|

The market price of our common stock prevailing at the time of sale;

|

|

2.

|

A price related to such prevailing market price of our common stock; or

|

|

3.

|

Such other price as the selling shareholders determine from time to time.

|

The shares may also be sold in compliance with the Securities and Exchange Commission’s rule 144.

We can provide no assurance that all or any of the common stock offered will be sold by the selling shareholders named in this prospectus.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling shareholders and any broker-dealers who execute sales for the selling shareholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

|

1.

|

Not engage in any stabilization activities in connection with our common stock;

|

|

2.

|

Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and

|

|

3.

|

Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act.

|

General

Our authorized capital stock consists of 75,000,000 shares of common stock, with a par value of $0.001 per share, and 5,000,000 shares of preferred stock, with a par value of $0.001 per share. As of September 22, 2010 , there were 5,950,000 shares of our common stock issued and outstanding held by thirty four (34) stockholders of record. There are no preferred shares issued.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy. Holders of our common stock representing thirty three and one-third percent (33 1/3%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividend Policy

We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover laws

Nevada revised statutes sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute does not apply to our company.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

John Kinross-Kennedy, C.P.A., our accountant, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in his audit report. John Kinross-Kennedy, C.P.A. has presented his report with respect to our audited financial statements. The financial statements have been included in this prospectus and registration statement in reliance on the report by John Kinross-Kennedy, C.P.A.,

given his authority as an expert in auditing and accounting. The report of John Kinross-Kennedy, C.P.A. on the financial statements herein includes an explanatory paragraph that states that we have not generated revenues and

have an accumulated deficit since inception which raises substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Karen A. Batcher, Esq of Synergen Law Group, APC our independent legal counsel, has provided an opinion on the validity of our common stock.

In General

Berry Only Inc. is a Nevada corporation that recently signed a milestone agreement with the U.S. manufacturer of Wireless Wipes™ to acquire the exclusive rights to distribute the product in Canada.

Wireless Wipes™ is a new, unique, first to market sanitizer designed specifically to clean mobile phones, PDA’s (personal digital assistants) and laptop computer screens. They are fast drying to prevent moisture damage, non-streaking and non-corrosive with a pleasant green tea-cucumber scent. Wireless Wipes™ are packaged in 10-count re-sealable pouches which can fit neatly in a shirt or jacket pocket. Retail prices are US $2.95 per pouch in the U.S. and Berry Only anticipates retail pricing in Canada of Cdn $3.50. Landed cost in Canada is US $1.40 per pouch, with a minimum order size of $300. (Landed cost is the total cost of a landed shipment including purchase price, freight, insurance, and other costs up to the port of destination.)

Demand for Wireless Wipes™ is expected to be driven by several factors.

|

1.

|

Mobile devices are in constant use, virtually all day and all night.

|

|

2.

|

These devices are filled with bacteria which can make them unhealthy if not cleaned and sanitized

|

Wireless Wipes have a number of competitive advantages over other cleaning / sanitizing products.

Wireless Wipes are specifically tailored for cell phones, PDAs etc. and several advantageous features have been designed into the product versus other methods of cleaning these devices.

|

■

|

They kill germs / bacteria in addition to cleaning the unit.

|

|

■

|

The amount and type of cleaning solution does not harm the unit and dries quickly.

|

|

■

|

Wireless Wipes™ are the ultimate in convenience – they are packaged in a very handy pouch that can easily accompany the person wherever they go – as opposed to bulky plastic dispensers or spray bottles

|

|

■

|

They are designed to have an attractive retail price point and are very amenable to placement at point of sale units.

|

Berry Only is positioning itself to capitalize on the Wireless Wipes opportunity, and expects to be successful based on several factors.

|

●

|

New and unique product with a well-defined need in the marketplace.

|

|

●

|

Proven distribution strategy through duplicating U.S. business model (use of direct sales strategy through several distribution channels – as detailed in “Marketing & Distribution”).

|

|

●

|

Good partner, the U.S. manufacturer of Wireless Wipes™. We also hope to attain good distribution channel partners in Canada.

|

|

●

|

Cost effective strategy , including several low cost methods such use of direct sales techniques (email, telephone), use of independent sales representatives, the online strategy, and select attendance at (the most) critical trade shows.

|

The Product

| Wireless Wipes™ is a new sanitizer designed specifically to clean mobile phones, PDA’s (personal digital assistants) and laptop computer screens. They are fast drying to prevent moisture damage, non-streaking and non-corrosive with a pleasant green tea-cucumber scent. Wireless Wipes™ comes in 10-count re-sealable pouches which can fit neatly in a shirt or jacket pocket.

Traditional wipes come in use different cleaning technologies and come in different shapes, sizes, and delivery systems.

|

|

|

|

Feature

|

Wireless Wipes |

|

Type of job

|

● |

Specifically designed for small mobile devices, which has an impact on each aspect of its design.

|

|

Ability to clean / disinfect.

|

● |

The chemical formulation for Wireless Wipes was in development for two years in order to create a highly absorbent, alcohol based sanitizer that Œ cleans, sanitizes, and Ž does not harm the sensitive screens and electronics of mobile devices.

Wireless Wipes are fast drying to prevent moisture damage, non-streaking and non-corrosive.

|

|

Types of material (cloth, paper, etc.).

|

● |

Material used does not streak or scratch display screens.

|

|

Degree of wetness.

|

● |

Wireless Wipes have been specifically designed to have a uniform amount of solution in each wipe – an amount sufficient to do an effective job while not too much so as to harm the unit.

|

|

How dispensed /

packaging (plastic tubs,

spray bottle, etc.)

|

● |

Wireless Wipes are packaged to enable the ultimate in convenience – a re-sealable 10-pack pouch. No spray bottle or bulky plastic container.

|

Need For the Product

Wireless Wipes were designed with two thoughts in mind:

|

1.

|

People use their mobile devices constantly, virtually all day and all night.

|

|

2.

|

These devices are filled with bacteria which can make them unhealthy if not cleaned and sanitized.

|

Cell phone subscribers in the Canadian market equal more than 21 million (2008 stat). Mobile devices have proven to be a breeding ground for bacteria and germs. A long list of bacteria that can cause everything from rashes to meningitis and pneumonia can be found on cell phones. The reason is simple: cell phones touch your face, your lips and your hands, then sit in your pocket or purse: two warm places that provide a perfect breeding ground for germs.

The global concern over flu outbreak provides an excellent opportunity to highlight the benefits of regular use of Wireless Wipes™.

Advantages of Wireless Wipes™

Wireless Wipes are specifically tailored for cell phones, PDAs etc. and several advantageous features have been designed into the product versus other methods of cleaning these devices.

|

■

|

They kill germs / bacteria.

|

|

■

|

They effectively clean the unit.

|

|

■

|

The amount and type of cleaning solution does not harm the unit.

|

|

■

|

They are convenient – packaged in a very convenient pouch rather than bulky dispensers or spray bottles – accordingly they are very portable and can accompany the owner on their person easily.

|

|

■

|

Convenient size of wipes.

|

Manufacturing & Product Fulfilment

The process from production through to placement on retail shelves is as follows:

Production. All aspects of manufacturing have been set up by Wireless Wipes and will occur at the California plant which has been, with all aspects managed by Wireless Wipes, based in New York state.

Shipment to Canada. Minimum order size for Berry Only is for $300. This is a delivered price to a Canadian destination (including shipment directly to a Berry Only customer).

Retail point of sale displays are provided by Wireless Wipes (approximately 5 displays per 400 ordered, or as needed by Berry Only).

Pricing strategy

Retail price points will be selected based on the following:

|

●

|

Given relatively low barriers to entry, an exorbitant price point will promote new competition and switching allegiances in short order.

|

|

●

|

The nature of the product and the ability to price it from $3.00 - $4.00 make it a perfect item for impulse point of sale purchases.

|

|

●

|

The price point will ensure that all parties in the manufacturing / delivery / retail chain will receive standard returns.

|

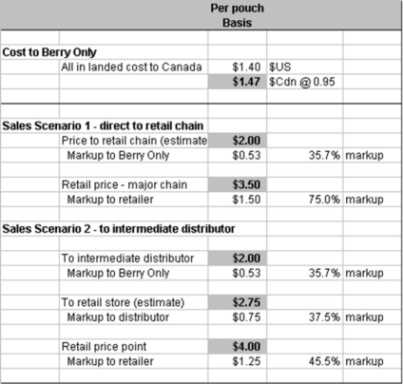

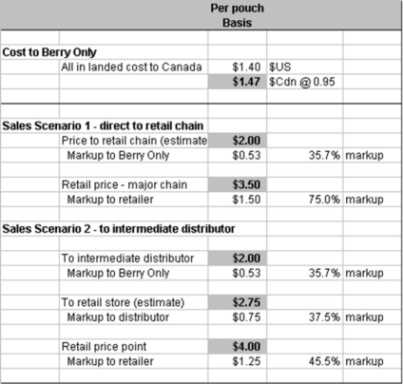

As shown, ultimate retail prices are envisioned at the $3.50 - $4.00 level. This compares to the US $2.95 price in the U.S. market (or about Cdn $3.10).

Relatively modest markups by Berry Only will help to keep retail prices in Canada from escalating much over domestic U.S. prices, and serve to inhibit future competition once the first mover advantage has been realized. Product prices are expected to be quite competitive since Berry Only Inc. is buying direct from the manufacturer. Another feature of this relationship which is of significant value to Berry Only Inc., is the willingness of the manufacturer to allow Berry Only Inc. to place orders as small as $300 US. This will assist Berry Only Inc. in their goal of efficient inventory management and allow Berry Only Inc. to offer competitively priced products that are of the highest quality.

Distribution Agreement with Wireless Wipes

Berry Only Inc. (the “Distributor”) is entered into an exclusive distributorship agreement with Wireless Wipes™ (the “Manufacturer”), on June 30, 2010, pursuant to which Berry Only was appointed as the exclusive distributor for Canada by the Manufacturer.

Details of the agreement are as follows:

|

|

|

|

●

|

Berry Only has the exclusive right, on the terms and conditions of the Exclusive Distributorship Agreement, to purchase, inventory, promote and resell Wireless Wipes’ products within the Country of Canada.

|

|

●

|

Berry Only is entitled to 30 days notice of any change to the prices or terms by the Manufacturer.

|

|

●

|

Manufacturer agrees to properly pack all items for shipment. Pricing is FOB Manufacturer's plant.

|

|

●

|

Minimum orders of US $300. Product will be prepaid as agreed by both parties.

|

|

●

|

1 week lead time for all orders.

|

|

●

|

Annual distribution of 10,000 pouches is expected or agreement becomes null and void. Berry Only has until June 30, 2011 to reach its annual distribution minimums.

|

|

●

|

The term of the Distributorship Agreement is 1 year ending June 30, 2011. At the end of the term, the Agreement shall continue until terminated by either party on at least ninety days prior notice.

|

Standard language is also contained in the agreement, including those relating to maintenance of appropriate inventories, use of best efforts to sell and vigorously promote the product to dealers, maintaining a place of business, hiring of sales personnel, non-compete (selling other products that compete with Wireless Wipes), mutual cooperation regarding advertising and promotion, manufacturers adjustments for any defective products, and maintenance of financial health. Berry Only has an excellent working relationship with Wireless Wipes (Manufacturer). This agreement forms the basis of all marketing efforts by Berry Only. It is important to understand differences between target markets (who ultimately uses the products), customers (who Berry Only actually sells to), and what the sales strategies are.

Target Markets

Berry Only Inc. expects to sell products to two customer segments.

|

1.

|

Individual Consumers. The first segment is individual consumers who are purchasing Wireless Wipes™ for personal use. These individuals are conscious consumers who are looking for quick and convenient ways to safeguard their personal hygiene by keeping personal technology germ-free. Demographics for this group are urban professionals leading a busy, technology saturated lifestyle.

|

|

2.

|

Institutional Users. This consists of large potential purchasers of Wireless Wipes™ that have a desire to keep their business equipment as germ free as possible. These include schools, offices, and IT departments.

|

Customers

Berry Only expects to sell to the following types of customers.

|

■

|

Major hygiene / sanitizing product distributors. This may include distributors that deal in sanitizing products.

|

|

■

|

Major regional cell phone retailers. There are a large number of strong, regional cell phone retailers in each major market area. These can be sourced by simply going to the service providers website (i.e. telus.com, rogers.com) and visit their store locator page. These stores are all independently owned and operated and are largely regionally based. These retailers all aggressively market cell phone accessories.

|

|

■

|

National Retailers. These include national chains.

|

|

■

|

Other retailers. There is a range of other retailers that sell cell phone accessories, primarily card products (i.e. pay and talk cards). However, these retailers also sell a range of other accessory products. These include gas stations, hotels, convenience stores, and cafes (i.e. a large number of Starbucks stores sell cell phone cards).

|

|

■

|

Online retailers. In the U.S., Wireless Wipes are already sold online, through ebay.com and other retailers. Berry Only intends to also target online retailers, particularly those that target the Canadian marketplace.

|

|

■

|

Retail customers. Berry Only Inc. intends to actively utilize it’s website berryonly.com to sell directly to consumers. Price points (which include shipping) will in no cases be lower than what the consumer can purchase Wireless Wipes for at retail locations and therefore does not pose a threat to its critical central distribution mechanism.

|

Distribution is expected to be through websites and affiliate programs, retail sales, wholesale distribution to resellers and corporate / institution accounts (hospitals, airports, etc.).

Affiliate marketing programs are a marketing practice in which a business rewards one or more affiliates for each visitor or customer brought about by the affiliate's marketing efforts. Berry Only has not established any affiliate relationships to date.

Direct Sales Strategy

|

♦

|

In-house sales staff – based in Toronto . Initially, company President David Guest will spearhead this effort out of his Toronto office. Efforts here will target national accounts as well as working with national distributors. David is also responsible for organizing independent marketing reps in other geographic areas. Institutional accounts in the Greater Toronto Area (GTA) will be handled out of the head office. As the company grows, these efforts are expected to require the efforts of more than one person and at such time, additional staff would be hired.

|

|

♦

|

Independent marketing representatives. Efforts here will focus on the regional cell phone dealers and directly to local institutional accounts (hospitals, etc. as mentioned above).

|

|

♦

|

Use of third party distributors. Third party distributors are obviously expected to utilize their in-house sales personnel to distribute Wireless Wipes to their customers.

|

Berry Only intends to attend major tradeshows, as appropriate (as Wireless Wipes now does to market to its’ U.S. customers). One good example is the annual Consumer Electronics Show in Las Vegas (January).

|

Advertising

Point of sale display. First and foremost, Wireless Wipes hopes to be attractively displayed at the point of purchase. Virtually every person that purchases items and passes through the check out should stand a very good chance of seeing the product. Its usefulness and low price point will encourage its purchase.

Depending on cost and effectiveness, Berry Only may advertise through local technology magazines.

Traditional advertising (i.e. traditional print such as newspapers, magazines, other media) is expected to be minimal, due to the nature of the nature of distribution / customers and nature of marketing (direct sales). Some advertising through local technology magazines is planned.

Other key strategies. As with the U.S. experience, a much more tech-savvy online advertising strategy will be followed. Berry Only will have the ability to “piggy back” on the efforts already in place being spearheaded by Wireless Wipes. These include:

|

|

|

|

■

|

Pursuing a variety of public relations activities, including media articles (i.e. providing interesting information to organizations that facilitate news articles).

|

|

■

|

Posting online content / articles.

|

|

■

|

Getting involved / posting content on online blogs.

|

|

■

|

Online search engine optimization strategy. (Search engine optimization is the process of improving the visibility of a web site or a web page in search engines via the "natural" or un-paid search results. In general, the earlier (or higher on the page), and more frequently a site appears in the search results list, the more visitors it will receive from the search engine. Search engine optimization may target different kinds of search, including image search, local search, video search and industry-specific vertical search engines. This gives a web site web presence.

|

|

■

|

All printed material such as brochures, flyers, catalogs, price sheets, packaging, and all product labels will have the URL prominently displayed.

|

|

■

|

There may be van and automobile decal wraps with the website and phone throughout each market area.

|

|

■

|

Possible use (depending on funding) of use industry portals, online directories, and paid–for advertising partner sites to draw consumers and property owners / managers to the site.

|

Website

Berry Only Inc. will actively utilize it’s website berryonly.com and include the product in it’s catalog (the catalog is the list of products offered on the website, the current Wireless Wipes Product will be the sole product at this time but if and when the manufacturer offers varieties ie. Scent the catalog may be expanded to include those products) as well as information regarding the product and the availability of distributor options. The website will have the following features.

|

■

|

Educational for the public (presenting a wide variety of interesting content).

|

|

■

|

Effective as a sales tool for its customers and as a tool for independent sales reps.

|

|

■

|

News articles posted online.

|

|

■

|

Information as to where the product is sold.

|

|

■

|

Sophisticated graphics design, including cool mapping features

|

|

■

|

Establish reciprocal links.

|

|

■

|

Online store intends to set up of an online payment system via PayPal and major credit card through merchant account.

|

The website will be maintained bi-weekly with new information.The site will both contain extensive information. However, at all times it will encourage viewers to contact Berry Only for more information in recognition of the basic direct sales strategy is the principal marketing strategy. Berry Only also will seek to establish affiliate programs with online retailers.

Berry Only intends to have the website operational in early December 2010.

Berry Only will continually monitor all its marketing activities to refine its activities and select the most appropriate ones to spend marketing dollars on as they become available.

Competition

There are essentially two aspects to competition considerations.

|

■

|

Other types of “wipes”. As pointed out in “The Product”, there are obviously a number of cleaning and sanitizing products that have been on the market for any number of years. These come in the form of various spray products (i.e. Lysol, etc.) and wipe products. There are several issues with respect to these products, including whether they will scratch the cell phone, whether they contain too much solution and will damage the cell phone, and whether the type of solution will cause other problems. There is also the issue of convenience

|

|

■

|

Direct competition. There is another product on the market, CleenCell® Wipes (www.cleencell.com), that has been on the market for roughly one year. Very similar claims are made to those of Wireless Wipes™. As stated on their website,

|

|

o

|

Cleen Cell® Wipes feature a patented formula designed to remove and prevent bacteria build-up on sensitive mobile electronics without damaging the screen or shell of the device.

|

|

o

|

Cleen Cell® Singles travel conveniently, providing an on the go solution for on the go devices and lifestyles. Keep them by your desk, in your purse or pocket, or in your car to use when and where needed, then dispose. It’s easy to practice good mobile hygiene with Cleen Cell® Wipes.

|

|

o

|

Cleen Cell® Wipes are safe on cell phones because they were designed from the ground up with cell phones in mind. We’ve been successfully testing and using them on cell phones and laptops for over one year without one complaint and countless thank yous.

|

|

o

|

Cleen Cell® Wipes feature a unique scratch, streak, static and lint-free cloth with special textures that reach to deep clean keypads, hinges, ear and mouthpieces and other hard to reach areas across any mobile device including digital cameras, music players, Bluetooth headsets, and other mobile electronics.

|

|

o

|

The Cleen Cell® disinfecting solution was designed from the ground up specifically with cell phones in mind. After much testing, calibration, and consultation with the medical community we mixed powerful germ fighting ingredients that help prevent germs on cell phones, yet are safe for the inside and outside of compact electronic devices.

|

|

o

|

Cleen Cell® Wipes also work great on your Bluetooth devices, digital cameras, TV remote controls, compact gaming systems, lap tops, keyboards, monitors, and more!

|

Clicking on the “buy online” tab of their website takes the viewer to the amazon.com website, where the wipes are priced at US $12.99 for a box which holds 24 individually wrapped wipes. This product is therefore considerably more expensive than Wireless Wipes™ (US $2.95 for a pack which includes 10 wipes). The site states that the item ships from and is sold by Cell Phone Wipes, Inc. Additional information (About Seller) indicates that “Hollywood Creations is the exclusive manufacturer of Cleen Cell® Wipes. Established in 2006, Hollywood Creations is based in West Hollywood, CA.”

The Cleen Cell is not available in Canada at this time and Berry Only intends to capitalize on its first mover advantage. It appears that the nature of packaging also makes Cleen Cell more expensive and far less amenable to POS displays (US$12.99 price point vs. $3.50 for Wireless Wipes™ in Canada).

|

■

|

Other. Other products are emerging, including

|

|

o

|

“Phone Kleen Pads “,a hospital disinfectant germicidal wipe for telephones and other telecommunications equipment. This disposable wipe kills staph and most germs on hard, non-porous surfaces. This product appears to be distributed by ANTONLINE is one of the nation's leading e-commerce suppliers of consumer electronics and computer equipment. ANTONLINE is proud to Partner with Amazon.com to provide Amazon customers with the finest products and fastest online order fulfilment in the industry. Searches failed to locate an actual website for the manufacturer and it appears that this is a product restricted to online sales only. It is also not a direct competitor to Wireless Wipes™.

|

|

o

|

“Fellowes Telephone Cleaning Wipes” (www. www.fellowes.com). 1) Pre-moistened cleaning wipes safely remove dust, dirt, and fingerprints. 2) Non-toxic, anti-static, and alcohol-free 3) Ideal for cleaning phones, headsets, or any equipment that comes in contact with the ear, mouth, or face 4) 100 ct. tub. Their website does not state that it kills germs or is safe for cell phones. Although this product has an attractive price point (US $11.37 for 100 wipes) it also comes in a relatively unattractive and large plastic “tub” that has virtually no convenience features.

|

Wireless Wipes have a number of competitive advantages over other cleaning / sanitizing products. Wireless Wipes are specifically tailored for cell phones, PDAs etc. and several advantageous features have been designed into the product versus other methods of cleaning these devices.

|

■

|

They kill germs / bacteria in addition to cleaning the unit.

|

|

■

|

The amount and type of cleaning solution does not harm the unit and dries quickly.

|

|

■

|

Wireless Wipes™ are the ultimate in convenience – they are packaged in a very handy pouch that can easily accompany the person wherever they go – as opposed to bulky plastic dispensers or spray bottles.

|

|

■

|

They are designed to have an attractive retail price point and are very amenable to placement at point of sale units.

|

U.S. Experience

Wireless Wipes™ was introduced into the U.S. market in early 2008 after two years in development. Manufacturing was secured at a quality facility in California, USA. In less than a year they signed several significant distribution agreements, including:

|

■

|

Wireless Xcessories Group (www.wirexgroup.com), a leading provider of cell phone accessories to dealers, distributors, retailers, agents and airtime carriers throughout the United States and Canada. Formed in 1988, they have created a variety of product lines, totaling over 3,000 items designed to appeal to the widest possible spectrum of wholesale buyers. Additionally, Wireless Xcessories supports our customers with a wide assortment of Value Added services, including customized retail packaging, displays, posters, marketing, and sales training materials, and free e-commerce websites.

|

|

■

|

Wireless Giant (www.wirelessgiant.com). Founded in 1996, Wireless Giant is an innovative wireless technology retailer specializing in cellular products and services. Headquartered in Madison Heights, Michigan, the company operates over 60 stores as well as a leading wholesale enterprise, the WirelesseMall.com. Wireless Giant offers multi-carrier options with several industry giants, and prides itself on the ability to provide all the services of wireless carriers. Wireless Giant maintains relationships with leading carriers and vendors for wireless products and is the “one-stop shop” for any wireless necessity. Wireless Giant has retail opportunities available and is positioned to become one of the nation’s top wireless retailers.

|

|

■

|

Wireless Zone (www.wirelesszone.com). At the dawn of the cell phone age, Wireless Zone® founder Russ Weldon started an instantly successful business called "The Car Phone Store" in Wethersfield, CT, in 1988. Their franchising model has proven highly successful and a count of retail stores on their website lists nearly 400 locations, primarily focused in the East, Southeast, and parts of the Midwest.

|

|

■

|

Airport Wireless / Techshowcase (www.techshowcase.com , www.airportwireless.com ). Techshowcase™ was conceived to meet the demand of the business traveler for high technology mobile electronics. These are people who otherwise may not have the opportunity to personally test sophisticated mobile devices before purchasing. In an age when every moment matters, Techshowcase stores will provide the business traveler the extraordinary opportunity to put airport dwell time to productive use. Techshowcase - 16 airport locations. Airport Wireless - 25 airport locations.

|

|

■

|

Wireless Paradise (www.wirelessparadise.biz). Based in Elizabethtown, KY, Wireless Paradise is a franchise with a mission to build the largest nationwide network of the best of the best in the wireless retail industry. Products include a full line of accessories, car chargers, wall chargers, desk chargers, cases, holsters, Bluetooth, headsets, batteries, car kits, data Items, miscellaneous, and GPS Applications.

|

Bulk purchases for schools, offices, and IT departments can be made directly from Wireless Wipes head office. Purchases can be made online, at the wireless wipes website (www.wirelesswipes.com/store.html). Prices are US $2.95 for a pouch of 10, US $25 for 11 pouches (of 10 wipes each), up to US $136 for 72 pouches. Shipping starts at US $2.49 for the single pouch of 10 wipes (total delivered cost of US $5.44.Wireless Wipes are also sold on www.fommy.com (The Wireless Superstore™).

Berry Only intends to also direct bulk purchases, if received, directly through the Wireless Wipes head office.

Employees

We have no employees as of the date of this prospectus other than our president. We currently do not conduct business as we are only in the development stage of our company. We plan to conduct our business largely through the outsourcing of experts in each particular area of our business.

Research and Development Expenditures

We have not incurred any material research or development expenditures since our incorporation.

Subsidiaries

We do not currently have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

Office Property

We maintain our executive office at 722B Kingston Rd, Toronto, Ontario, Canada, M4E 1R7. This office space is being provided to the company free of charge by our president, Mr. Guest. This arrangement provides us with the office space necessary at this point. Upon significant growth of the company it may become necessary to lease or acquire additional or alternative space to accommodate our development activities and growth.

We are not currently a party to any legal proceedings.

Our agent for service of process in Nevada is Nevada Agency and Trust Company, 50 West Liberty Street, Suite 880, Reno, Nevada 89501.

Market for Common Equity and Related Stockholder Matters

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate making an application for trading of our common stock on the Over-the-Counter Bulletin Board electronic quotation service upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the Over-the-Counter Bulletin Board electronic quotation service or, if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

Berry Only Inc. is subject to the penny stock rules, and disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock and stockholders may have difficulty selling those securities.

Holders of Our Common Stock

As of the date of this Registration Statement, we had thirty four (34) shareholders of record.

Rule 144 Shares

None of our common stock is currently available for resale to the public under Rule 144. In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least 180 days is entitled to sell his or her shares. However, Rule 144 is not available to shareholders for at least one year subsequent to an issuer that previously met the definition of Rule 144(i)(1)(i) having publicly filed, on Form 8K, the information required by Form 10.

As of the date of this prospectus, no selling shareholder has held their shares for more than 180 days and it has not been at least one year since the company filed the Form 10 Information on Form 8K as contemplated by Rule 144(i)(2) and (3). Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

We are paying the expenses of the offering because we seek to: (i) become a reporting company with the Commission under the Securities Exchange Act of 1934; and (ii) enable our common stock to be traded on the NASD over-the-counter bulletin board. We plan to file a Form 8-A registration statement

with the Commission to cause us to become a reporting company with the Commission under the 1934 Act. We must be a reporting company under the 1934 Act in order that our common stock is eligible for trading on the NASD over-the-counter bulletin board. We believe that the registration of the resale of shares on behalf of existing shareholders may facilitate the development of a public market in our common stock if our common stock is approved for trading on a recognized market for the trading of securities in the United States.

We consider that the development of a public market for our common stock will make an investment in our common stock more attractive to future investors. In the near future, in order for us to continue with our development stage activities, we will need to raise additional capital. We believe that obtaining reporting company status under the 1934 Act and trading on the OTCBB should increase our ability to raise these additional funds from investors.

Index to Financial Statements:

Audited consolidated financial statements for the period ended June 30, 2010, including:

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To: The Board of Directors and Stockholders

Berry Only Inc.