Enter into Definitive Merger Agreement Phase 3 Clinical Stage Immuno-Oncology Company Addressing Major Obstacles to Overcoming Resistance to Cancer Immunotherapy

Forward-Looking Statements This presentation contains forward-looking statements that are not historical facts within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and other future conditions. In some cases you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. Examples of such forward-looking statements include but are not limited to express or implied statements regarding Kintara’s or TuHURA’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: the proposed merger transaction between Kintara and TUHURA (the “Proposed Transaction”) and the expected effects, perceived benefits or opportunities and related timing with respect thereto, expectations regarding clinical trials and research and development programs, in particular with respect to TuHURA’s IFx-Hu2.0 product candidate and its TME modulators development program, and any developments or results in connection therewith; the anticipated timing of the results from those studies and trials; expectations regarding the use of capital resources, including the net proceeds from the financing that closed in connection with the signing of the definitive agreement, and the time period over which the combined company’s capital resources will be sufficient to fund its anticipated operations; and the expected trading of the combined company’s stock on the Nasdaq Capital Market. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. You are cautioned that such statements are not guarantees of future performance and that actual results or developments may differ materially from those set forth in these forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include: the risk that the conditions to the closing or consummation of the Proposed Transaction are not satisfied, including the failure to obtain stockholder approval for the Proposed Transaction; uncertainties as to the timing of the consummation of the Proposed Transaction and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the Proposed Transaction; risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the Proposed Transaction, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Proposed Transaction by either company; the effect of the announcement or pendency of the Proposed Transaction on Kintara’s or TuHURA’s business relationships, operating results and business generally; costs related to the merger; the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the merger agreement or the transactions contemplated thereby; the ability of Kintara or TuHURA to protect their respective intellectual property rights; competitive responses to the Proposed Transaction; unexpected costs, charges or expenses resulting from the Proposed Transaction; whether the combined business of TuHURA and Kintara will be successful; legislative, regulatory, political and economic developments; and additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the SEC. Additional assumptions, risks and uncertainties are described in detail in our registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. The forward-looking statements and other information contained in this presentation are made as of the date hereof and Kintara does not undertake any obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. Nothing herein shall constitute an offer to sell or the solicitation of an offer to buy any securities.

President, CEO, CFO and Chairman of the Board Kintara Therapeutics Robert E. Hoffman

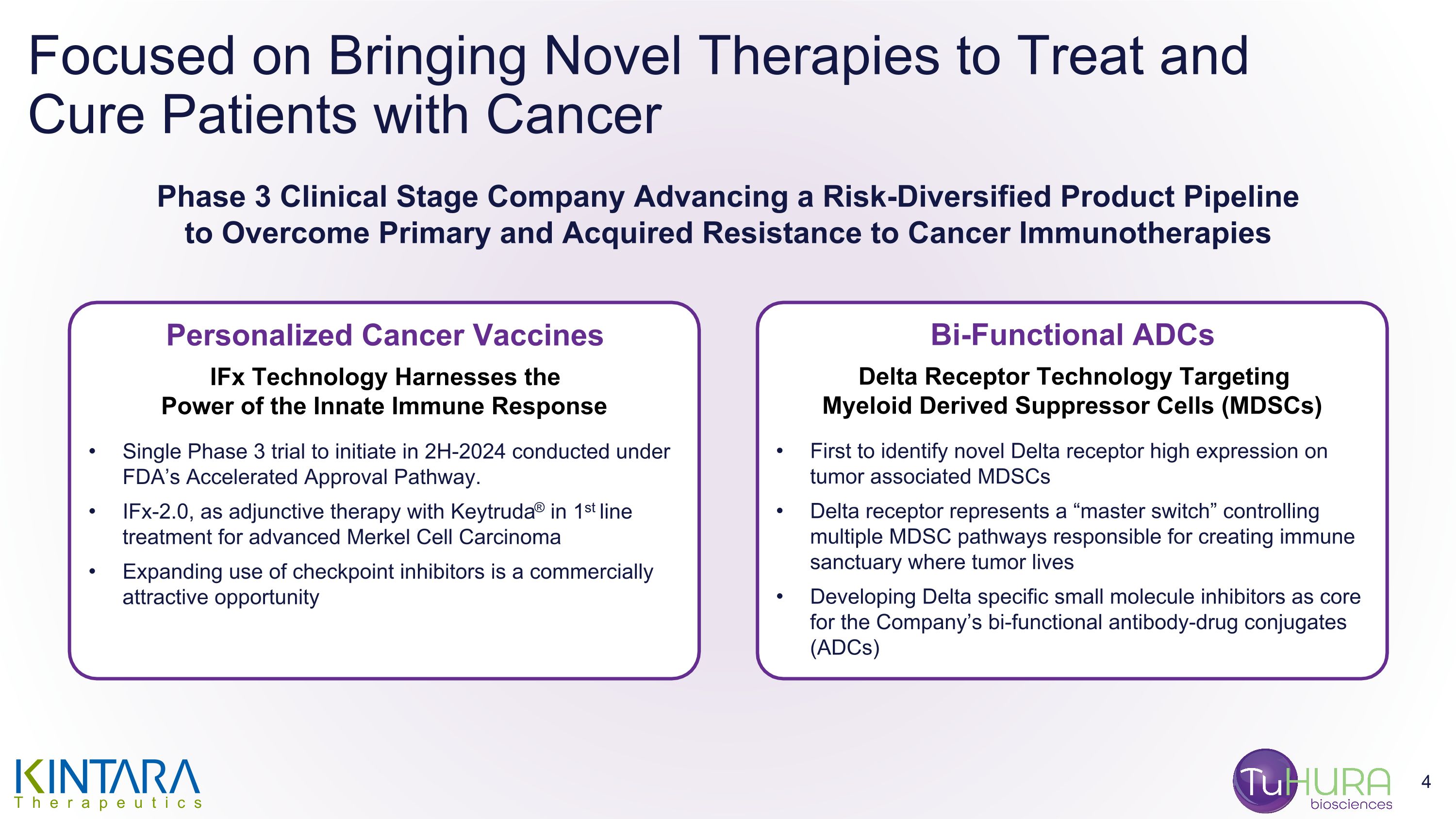

Focused on Bringing Novel Therapies to Treat and Cure Patients with Cancer Phase 3 Clinical Stage Company Advancing a Risk-Diversified Product Pipeline to Overcome Primary and Acquired Resistance to Cancer Immunotherapies Personalized Cancer Vaccines IFx Technology Harnesses the Power of the Innate Immune Response Single Phase 3 trial to initiate in 2H-2024 conducted under FDA’s Accelerated Approval Pathway. IFx-2.0, as adjunctive therapy with Keytruda® in 1st line treatment for advanced Merkel Cell Carcinoma Expanding use of checkpoint inhibitors is a commercially attractive opportunity Bi-Functional ADCs Delta Receptor Technology Targeting Myeloid Derived Suppressor Cells (MDSCs) First to identify novel Delta receptor high expression on tumor associated MDSCs Delta receptor represents a “master switch” controlling multiple MDSC pathways responsible for creating immune sanctuary where tumor lives Developing Delta specific small molecule inhibitors as core for the Company’s bi-functional antibody-drug conjugates (ADCs)

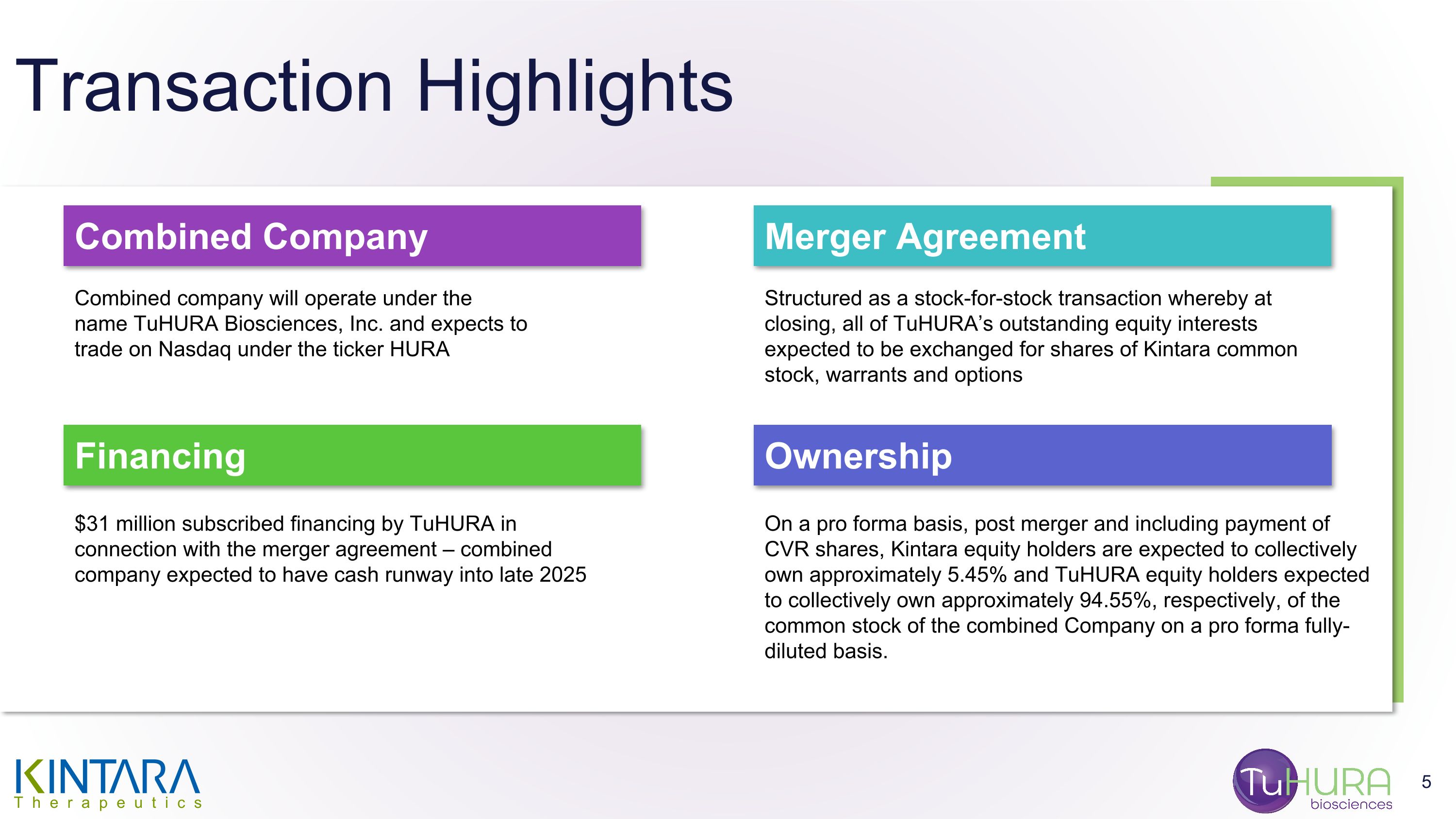

Transaction Highlights TEXT Combined company will operate under the name TuHURA Biosciences, Inc. and expects to trade on Nasdaq under the ticker HURA Structured as a stock-for-stock transaction whereby at closing, all of TuHURA’s outstanding equity interests expected to be exchanged for shares of Kintara common stock, warrants and options $31 million subscribed financing by TuHURA in connection with the merger agreement – combined company expected to have cash runway into late 2025 On a pro forma basis, post merger and including payment of CVR shares, Kintara equity holders are expected to collectively own approximately 5.45% and TuHURA equity holders expected to collectively own approximately 94.55%, respectively, of the common stock of the combined Company on a pro forma fully-diluted basis. Combined Company Merger Agreement Financing Ownership

James A Bianco, MD President and Chief Executive Officer TuHURA Biosciences

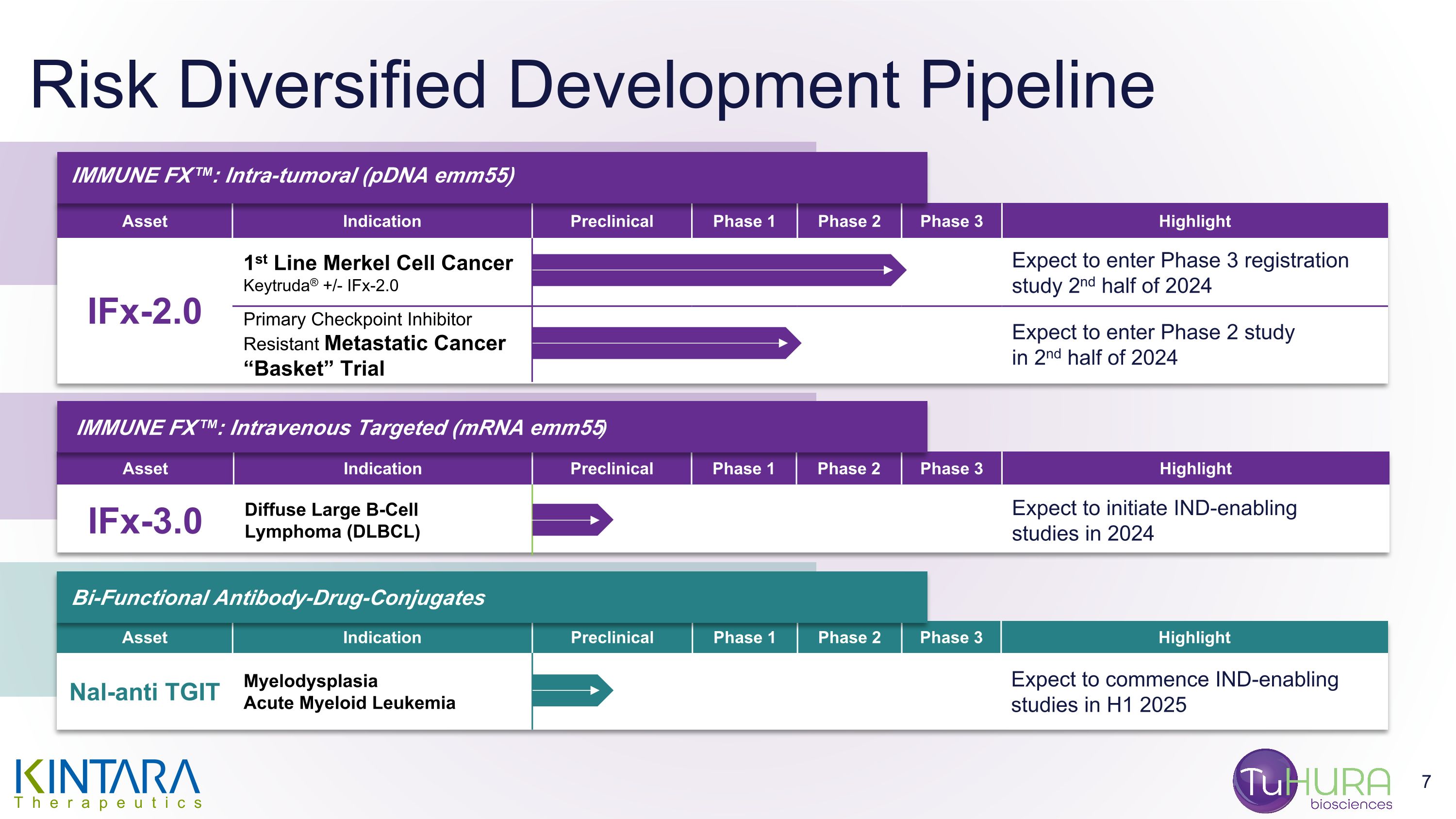

Risk Diversified Development Pipeline Asset Indication Preclinical Phase 1 Phase 2 Phase 3 Highlight IFx-3.0 Diffuse Large B-Cell Lymphoma (DLBCL) Expect to initiate IND-enabling studies in 2024 Asset Indication Preclinical Phase 1 Phase 2 Phase 3 Highlight Nal-anti TGIT Myelodysplasia Acute Myeloid Leukemia Expect to commence IND-enabling studies in H1 2025 Asset Indication Preclinical Phase 1 Phase 2 Phase 3 Highlight IFx-2.0 1st Line Merkel Cell Cancer Keytruda® +/- IFx-2.0 Expect to enter Phase 3 registration study 2nd half of 2024 IFx-Hu2.0 Primary Checkpoint Inhibitor Resistant Metastatic Cancer “Basket” Trial Expect to enter Phase 2 study in 2nd half of 2024 IMMUNE FX™: Intra-tumoral (pDNA emm55) IMMUNE FX™: Intravenous Targeted (mRNA emm55) Bi-Functional Antibody-Drug-Conjugates

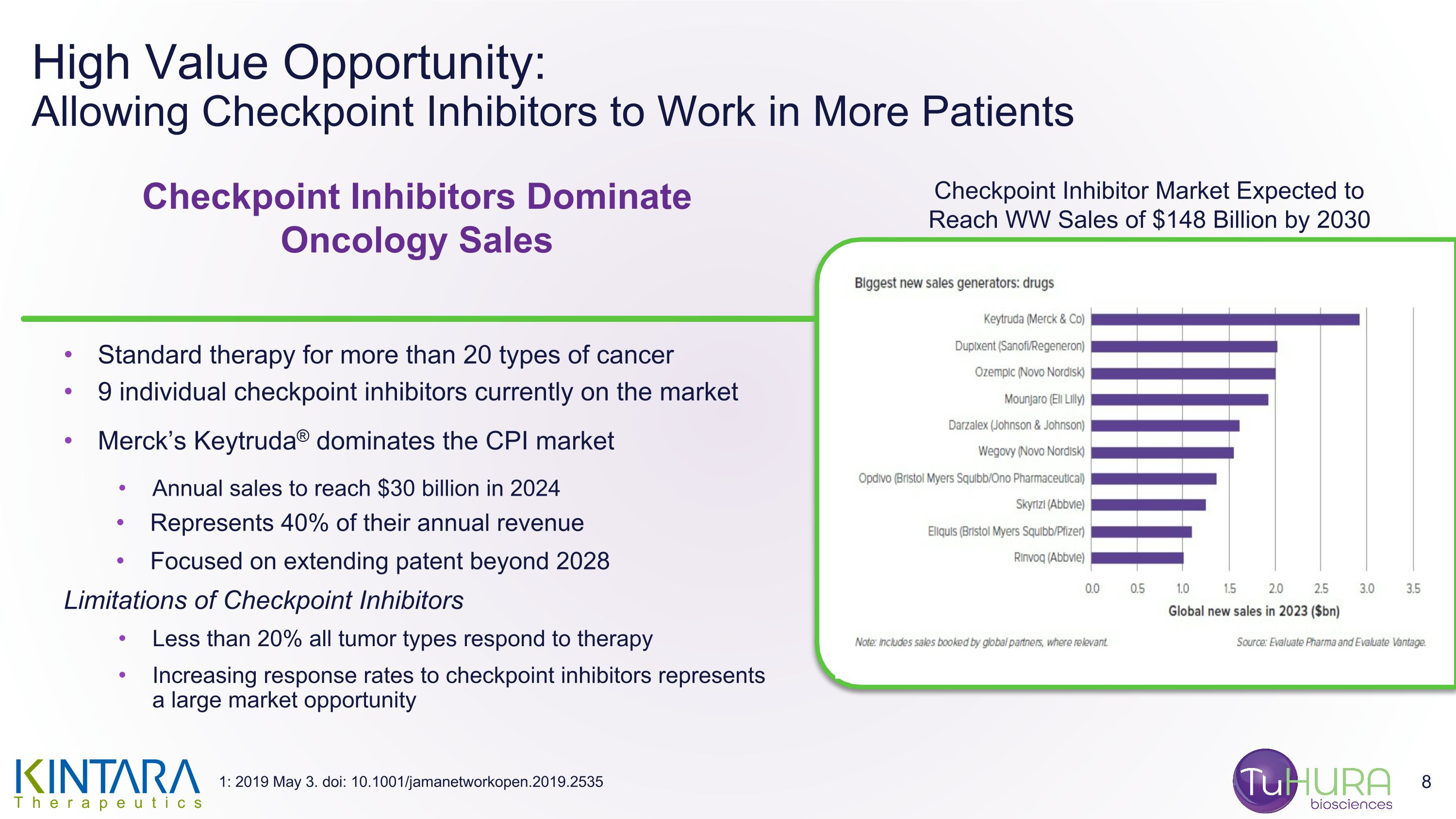

High Value Opportunity: Allowing Checkpoint Inhibitors to Work in More Patients Standard therapy for more than 20 types of cancer 9 individual checkpoint inhibitors currently on the market Merck’s Keytruda® dominates the CPI market Annual sales to reach $30 billion in 2024 Represents 40% of their annual revenue Focused on extending patent beyond 2028 Limitations of Checkpoint Inhibitors Less than 20% all tumor types respond to therapy Increasing response rates to checkpoint inhibitors represents a large market opportunity Checkpoint Inhibitors Dominate Oncology Sales Checkpoint Inhibitor Market Expected to Reach WW Sales of $148 Billion by 2030 1: 2019 May 3. doi: 10.1001/jamanetworkopen.2019.2535

Designed to Overcome Primary Resistance and Increase Response Rates to Checkpoint Inhibitor Therapy IFx-2.0 Personalized Cancer Vaccine

IFx Personalized Cancer Vaccine Technology Checkpoint Inhibitors need an activated immune response to work IFx-2.0 makes patient’s entire tumor appear foreign activating the innate immune response allowing checkpoint inhibitors to work where they previously failed Intra-tumoral injection of pDNA encodes for immunogenic bacterial protein expressed on surface of tumor cell Molecular patterns of the bacterial proteins are recognized by pattern recognition receptors on our immune cells like antigen presenting cells (APCs) These receptors “pre-programmed” over evolution to recognize specific patterns on bacteria and naturally activates the body’s innate immune response Activated APCs digest the tumor and present the foreign tumor antigens to educate B cells and T cells Tumor specific B cells produce antibodies to seek out and, together with tumor specific cytotoxic T cells, destroy tumor cells Making Cancer Cells Look Like Bacteria

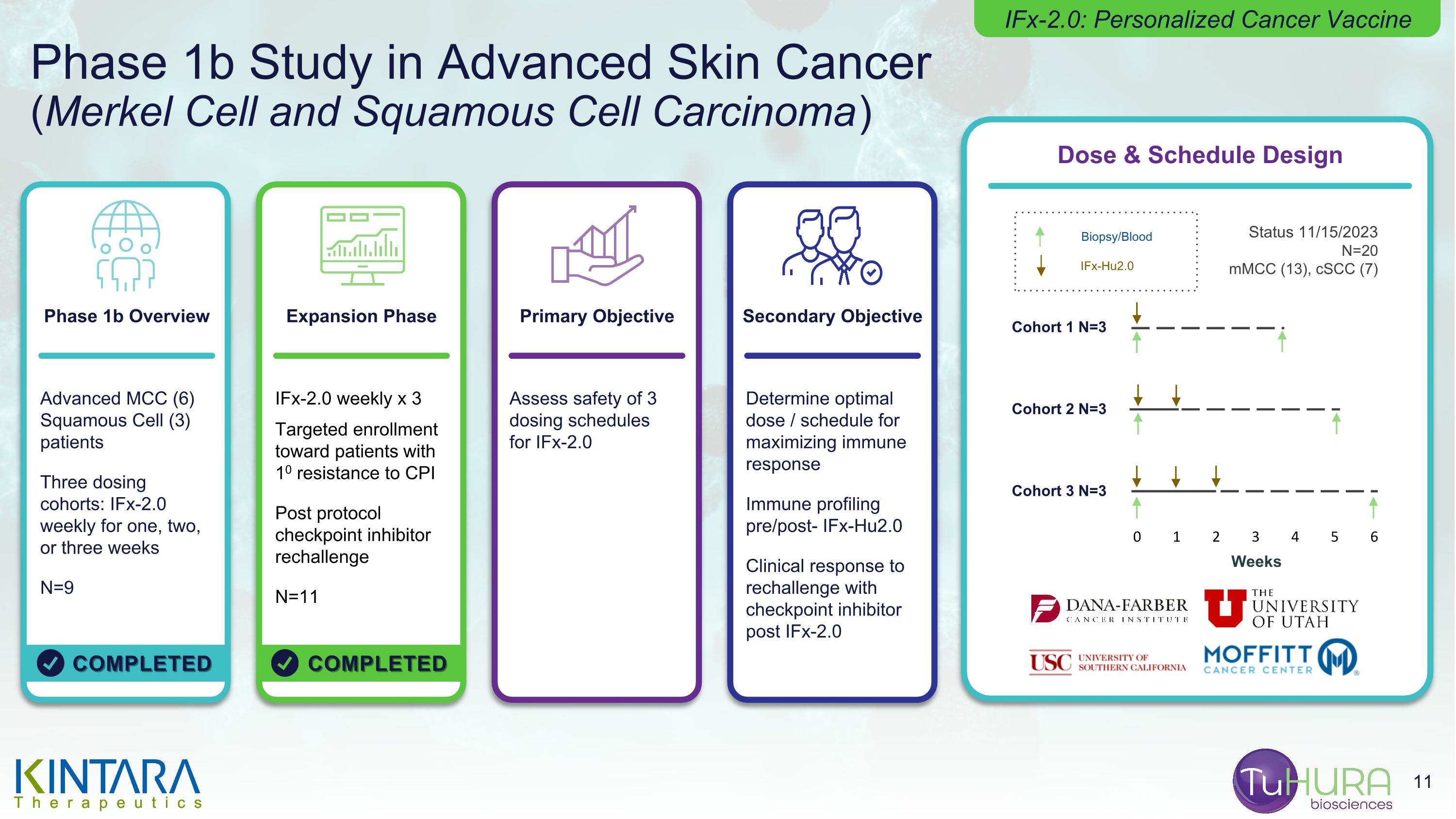

Phase 1b Study in Advanced Skin Cancer (Merkel Cell and Squamous Cell Carcinoma) IFx-2.0: Personalized Cancer Vaccine Advanced MCC (6) Squamous Cell (3) patients Three dosing cohorts: IFx-2.0 weekly for one, two, or three weeks N=9 IFx-2.0 weekly x 3 Targeted enrollment toward patients with 10 resistance to CPI Post protocol checkpoint inhibitor rechallenge N=11 Assess safety of 3 dosing schedules for IFx-2.0 Determine optimal dose / schedule for maximizing immune response Immune profiling pre/post- IFx-Hu2.0 Clinical response to rechallenge with checkpoint inhibitor post IFx-2.0 Primary Objective Secondary Objective Expansion Phase Phase 1b Overview COMPLETED COMPLETED IFx-Hu2.0 Biopsy/Blood Status 11/15/2023 N=20 mMCC (13), cSCC (7) Cohort 1 N=3 Cohort 2 N=3 Cohort 3 N=3 Weeks 0 1 2 3 4 5 6 Dose & Schedule Design

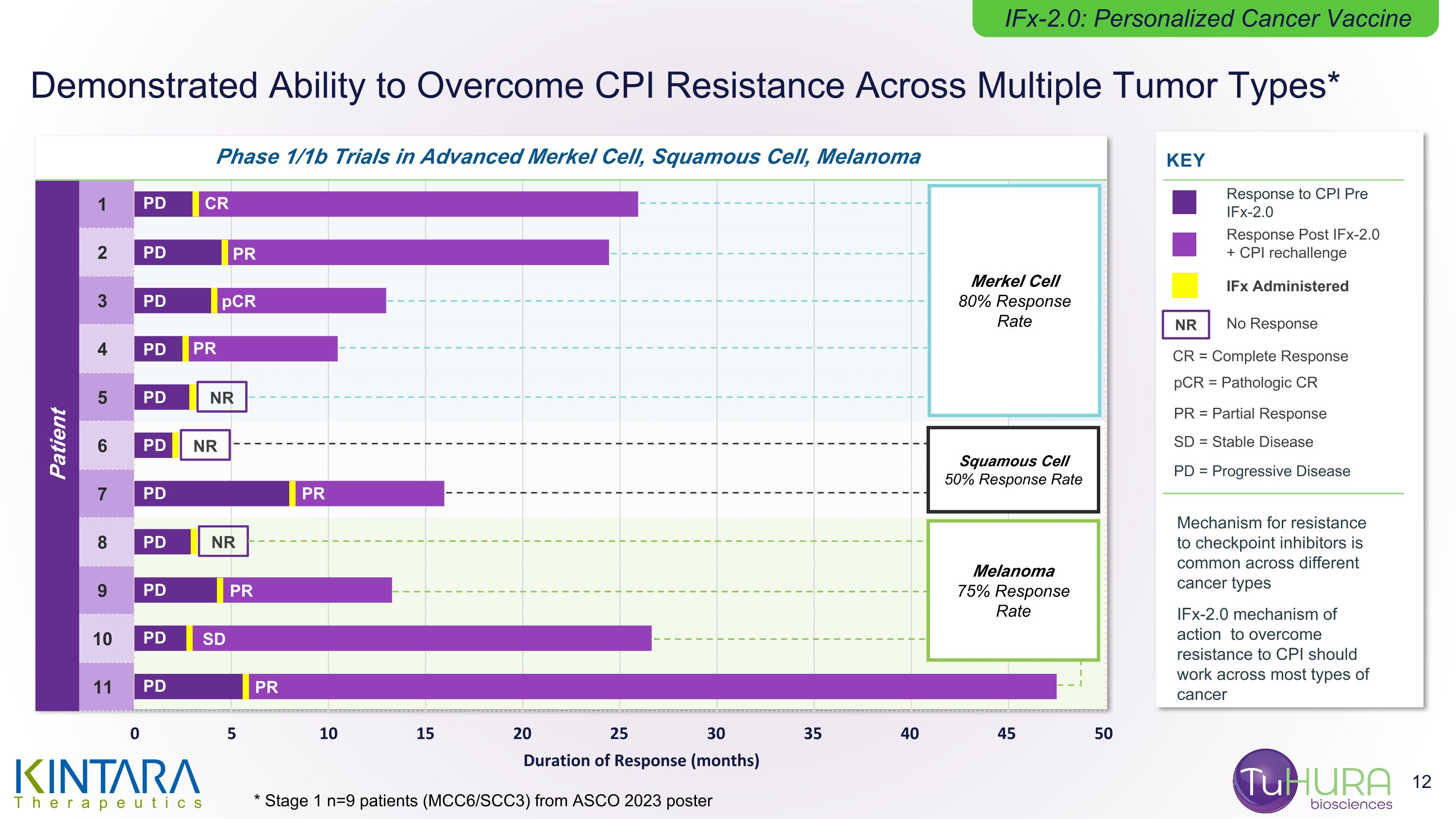

Demonstrated Ability to Overcome CPI Resistance Across Multiple Tumor Types* IFx-2.0: Personalized Cancer Vaccine 1 2 3 4 5 6 7 8 9 10 11 Phase 1/1b Trials in Advanced Merkel Cell, Squamous Cell, Melanoma Patient KEY NR NR NR PD PD PD PD PD PD PD PD PD PD PD CR PR pCR PR PR PR SD PR Merkel Cell 80% Response Rate Squamous Cell 50% Response Rate Melanoma 75% Response Rate Response Post IFx-2.0 + CPI rechallenge Response to CPI Pre IFx-2.0 No Response NR SD = Stable Disease PR = Partial Response CR = Complete Response pCR = Pathologic CR PD = Progressive Disease Mechanism for resistance to checkpoint inhibitors is common across different cancer types IFx-2.0 mechanism of action to overcome resistance to CPI should work across most types of cancer * Stage 1 n=9 patients (MCC6/SCC3) from ASCO 2023 poster IFx Administered

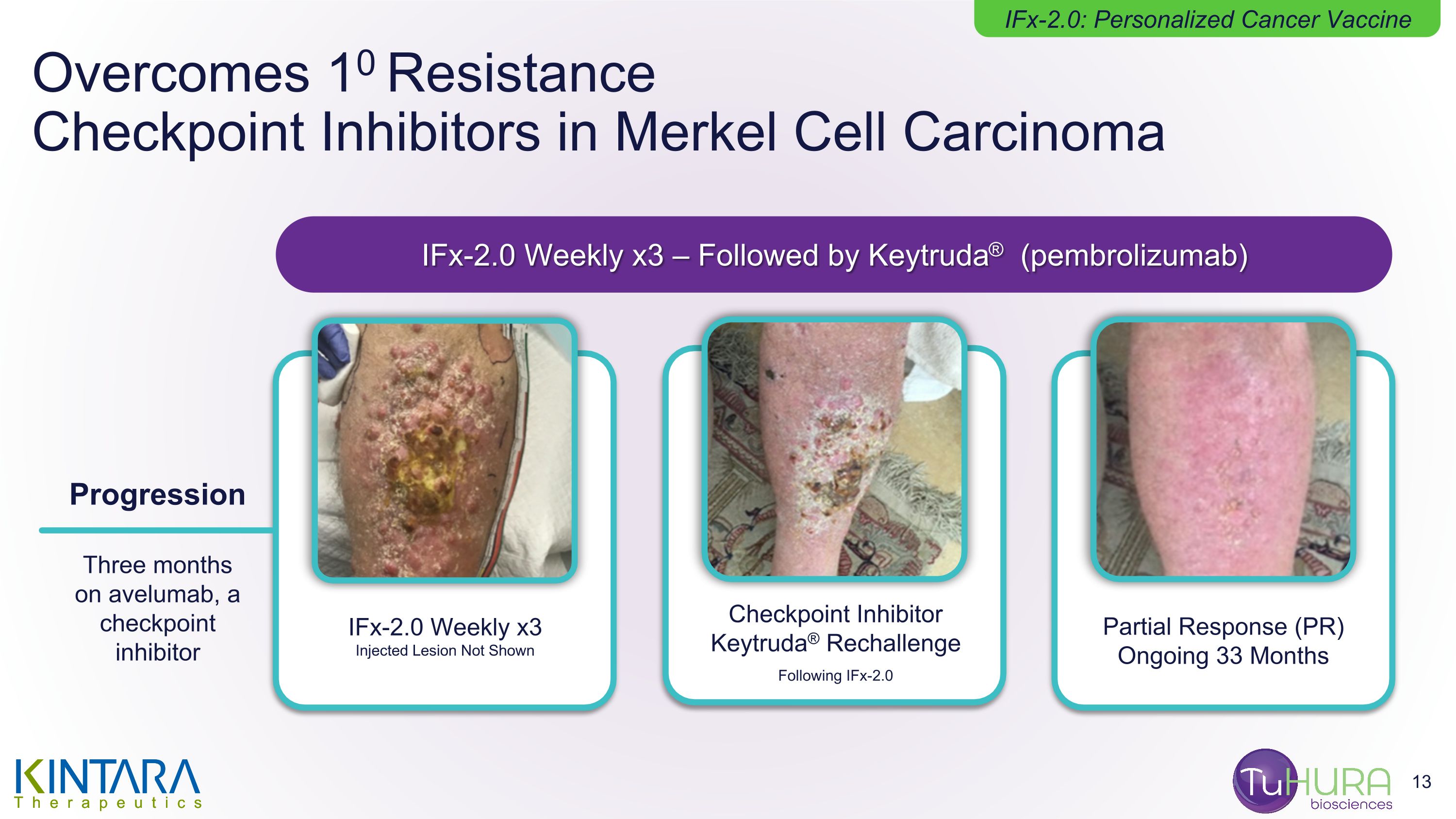

Overcomes 10 Resistance Checkpoint Inhibitors in Merkel Cell Carcinoma Progression Three months on avelumab, a checkpoint inhibitor IFx-2.0 Weekly x3 Injected Lesion Not Shown Checkpoint Inhibitor Keytruda® Rechallenge Following IFx-2.0 Partial Response (PR) Ongoing 33 Months IFx-2.0 Weekly x3 – Followed by Keytruda® (pembrolizumab) IFx-2.0: Personalized Cancer Vaccine

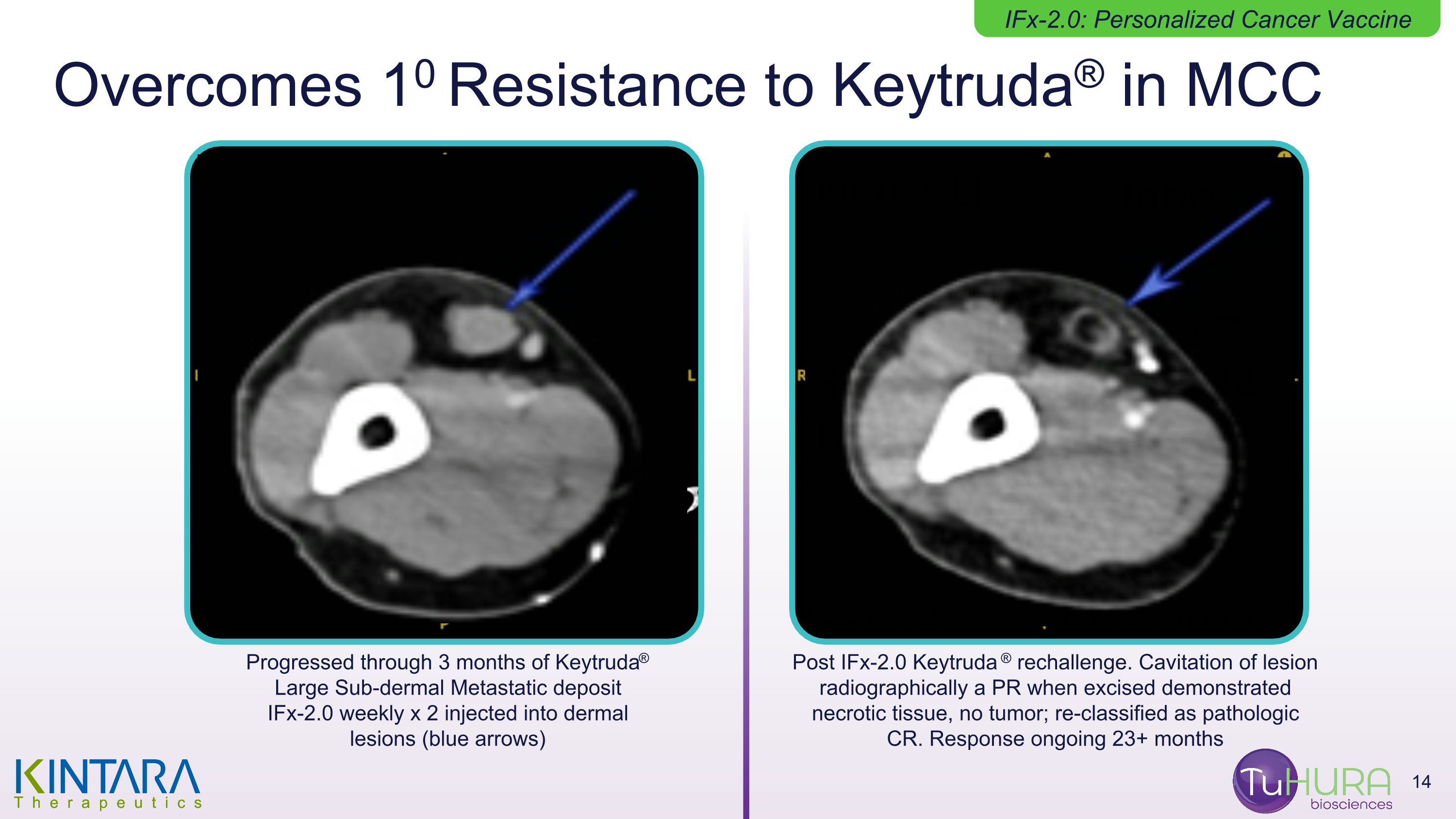

Overcomes 10 Resistance to Keytruda® in MCC Progressed through 3 months of Keytruda® Large Sub-dermal Metastatic deposit IFx-2.0 weekly x 2 injected into dermal lesions (blue arrows) Post IFx-2.0 Keytruda ® rechallenge. Cavitation of lesion radiographically a PR when excised demonstrated necrotic tissue, no tumor; re-classified as pathologic CR. Response ongoing 23+ months IFx-2.0: Personalized Cancer Vaccine

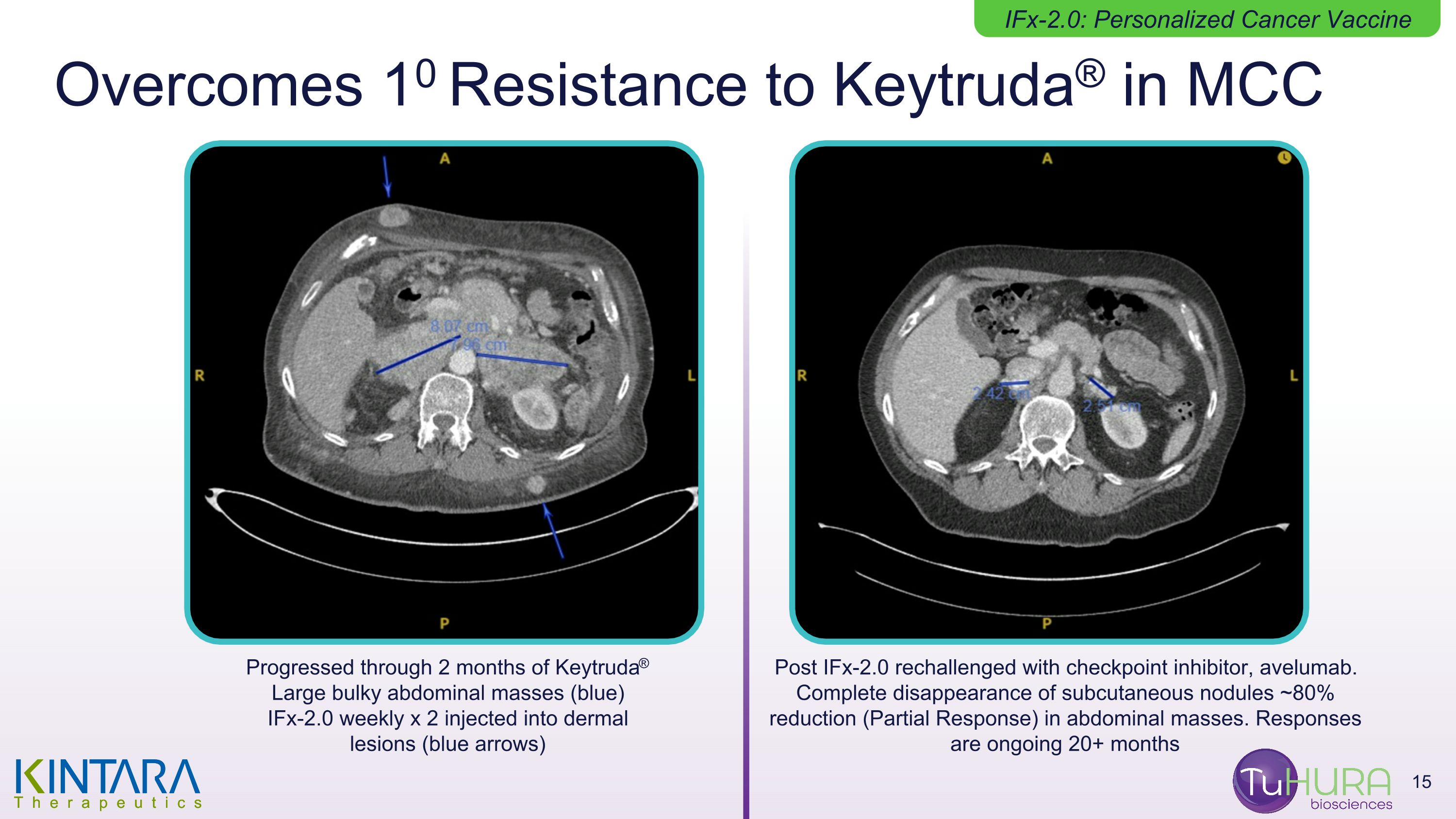

Progressed through 2 months of Keytruda® Large bulky abdominal masses (blue) IFx-2.0 weekly x 2 injected into dermal lesions (blue arrows) Post IFx-2.0 rechallenged with checkpoint inhibitor, avelumab. Complete disappearance of subcutaneous nodules ~80% reduction (Partial Response) in abdominal masses. Responses are ongoing 20+ months Overcomes 10 Resistance to Keytruda® in MCC IFx-2.0: Personalized Cancer Vaccine

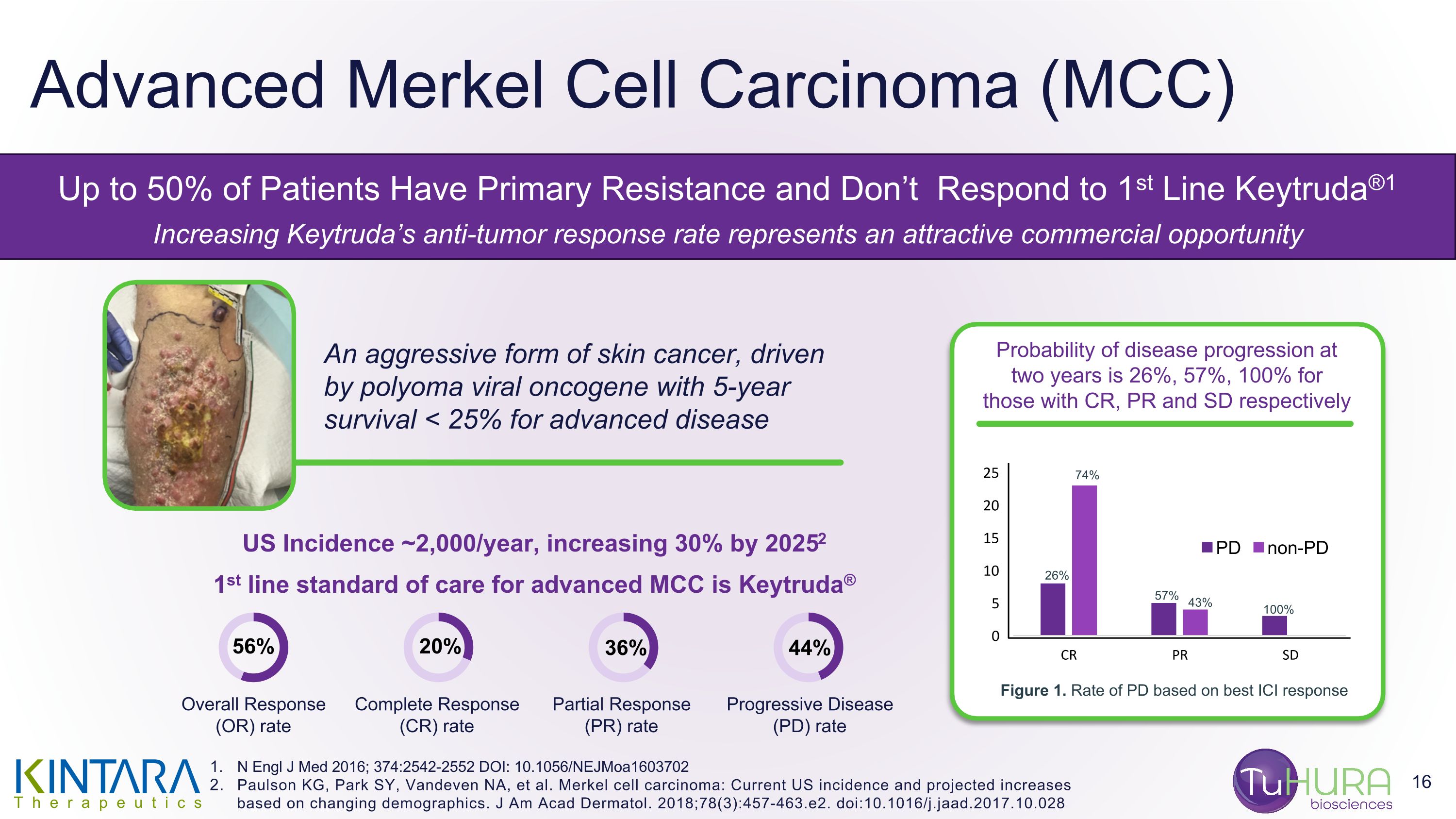

Advanced Merkel Cell Carcinoma (MCC) Up to 50% of Patients Have Primary Resistance and Don’t Respond to 1st Line Keytruda®1 Increasing Keytruda’s anti-tumor response rate represents an attractive commercial opportunity An aggressive form of skin cancer, driven by polyoma viral oncogene with 5-year survival < 25% for advanced disease US Incidence ~2,000/year, increasing 30% by 20252 1st line standard of care for advanced MCC is Keytruda® Probability of disease progression at two years is 26%, 57%, 100% for those with CR, PR and SD respectively 26% 74% 57% 43% 100% Figure 1. Rate of PD based on best ICI response 56% Overall Response (OR) rate Complete Response (CR) rate Partial Response (PR) rate Progressive Disease (PD) rate 20% 36% 44% N Engl J Med 2016; 374:2542-2552 DOI: 10.1056/NEJMoa1603702 Paulson KG, Park SY, Vandeven NA, et al. Merkel cell carcinoma: Current US incidence and projected increases based on changing demographics. J Am Acad Dermatol. 2018;78(3):457-463.e2. doi:10.1016/j.jaad.2017.10.028

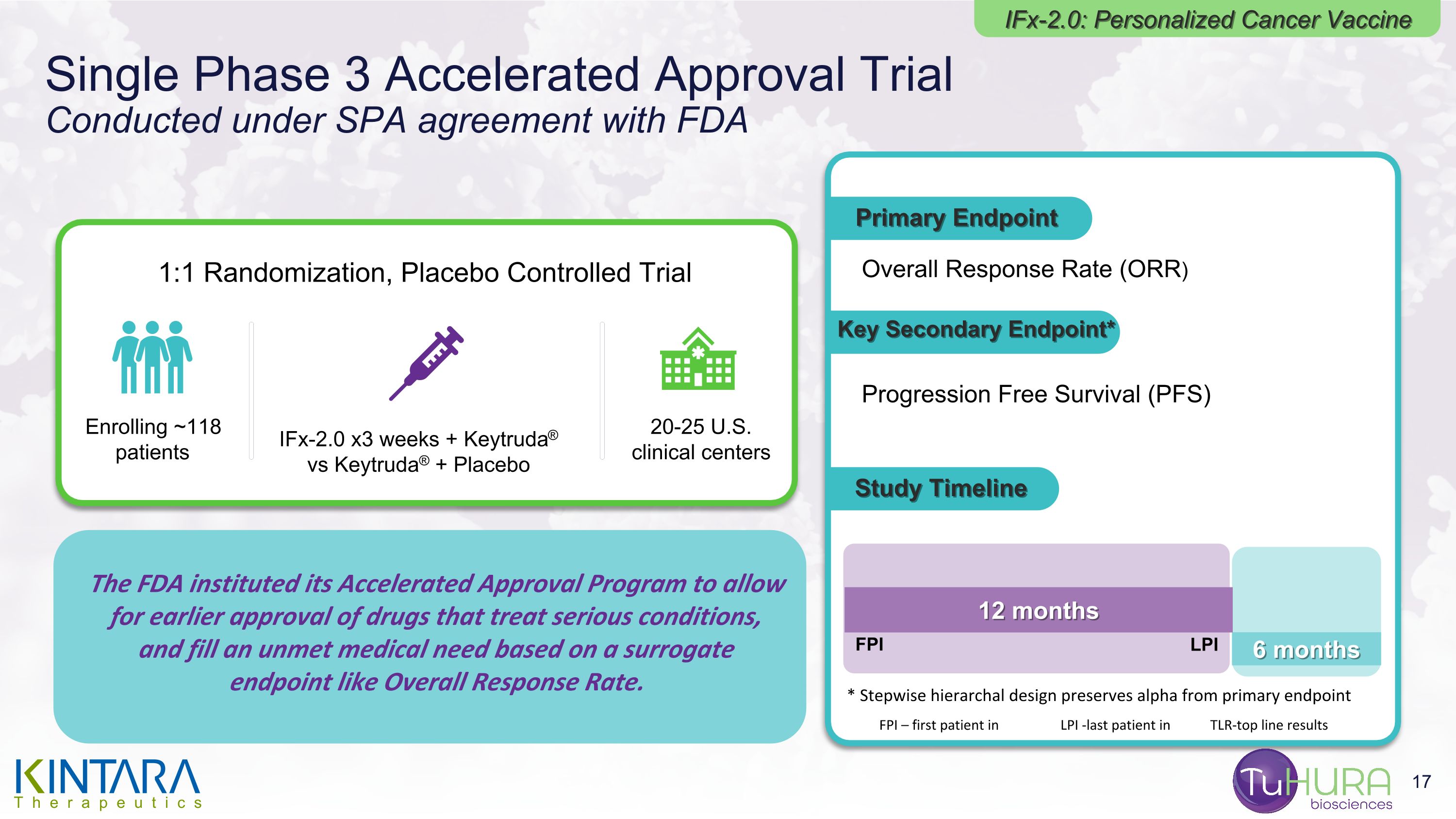

Single Phase 3 Accelerated Approval Trial Conducted under SPA agreement with FDA IFx-2.0: Personalized Cancer Vaccine 1:1 Randomization, Placebo Controlled Trial Enrolling ~118 patients IFx-2.0 x3 weeks + Keytruda® vs Keytruda® + Placebo 20-25 U.S. clinical centers Primary Endpoint Overall Response Rate (ORR) Key Secondary Endpoint* Progression Free Survival (PFS) Study Timeline 6 months TLR 12 months FPI LPI FPI – first patient in LPI -last patient in TLR-top line results The FDA instituted its Accelerated Approval Program to allow for earlier approval of drugs that treat serious conditions, and fill an unmet medical need based on a surrogate endpoint like Overall Response Rate. * Stepwise hierarchal design preserves alpha from primary endpoint

Oncology Accelerated Approval Trials Are A “Select” Group 54* 12,258 Ongoing Phase 3 cancer trials * Mostly large pharma/biotech

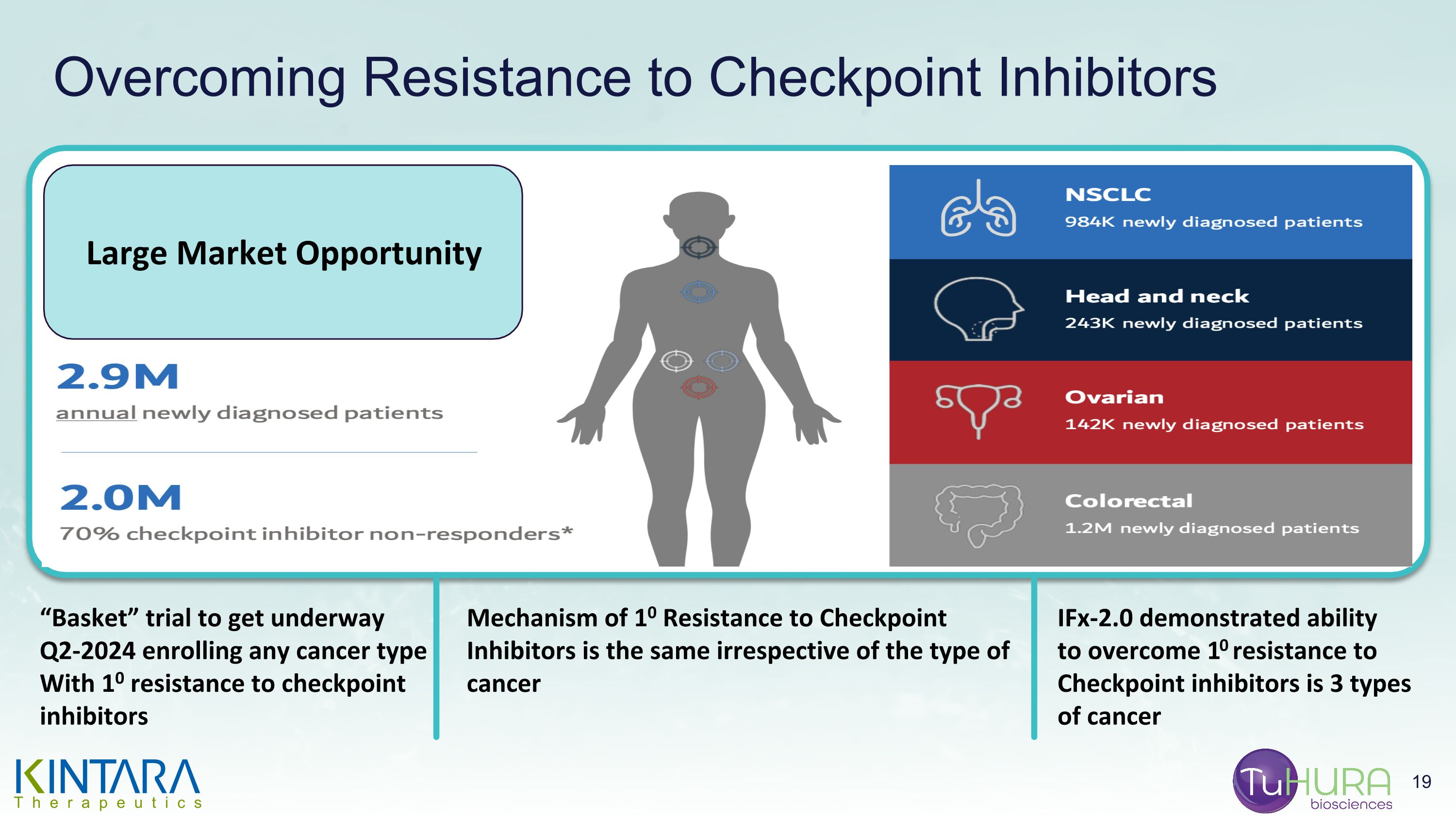

Overcoming Resistance to Checkpoint Inhibitors Large Market Opportunity Mechanism of 10 Resistance to Checkpoint Inhibitors is the same irrespective of the type of cancer IFx-2.0 demonstrated ability to overcome 10 resistance to Checkpoint inhibitors is 3 types of cancer “Basket” trial to get underway Q2-2024 enrolling any cancer type With 10 resistance to checkpoint inhibitors

IFx-3.0 – Tumor Targeted mRNA Personalized Cancer Vaccine Designed to Overcome Primary Resistance to Checkpoint Inhibitors and Cellular Therapies

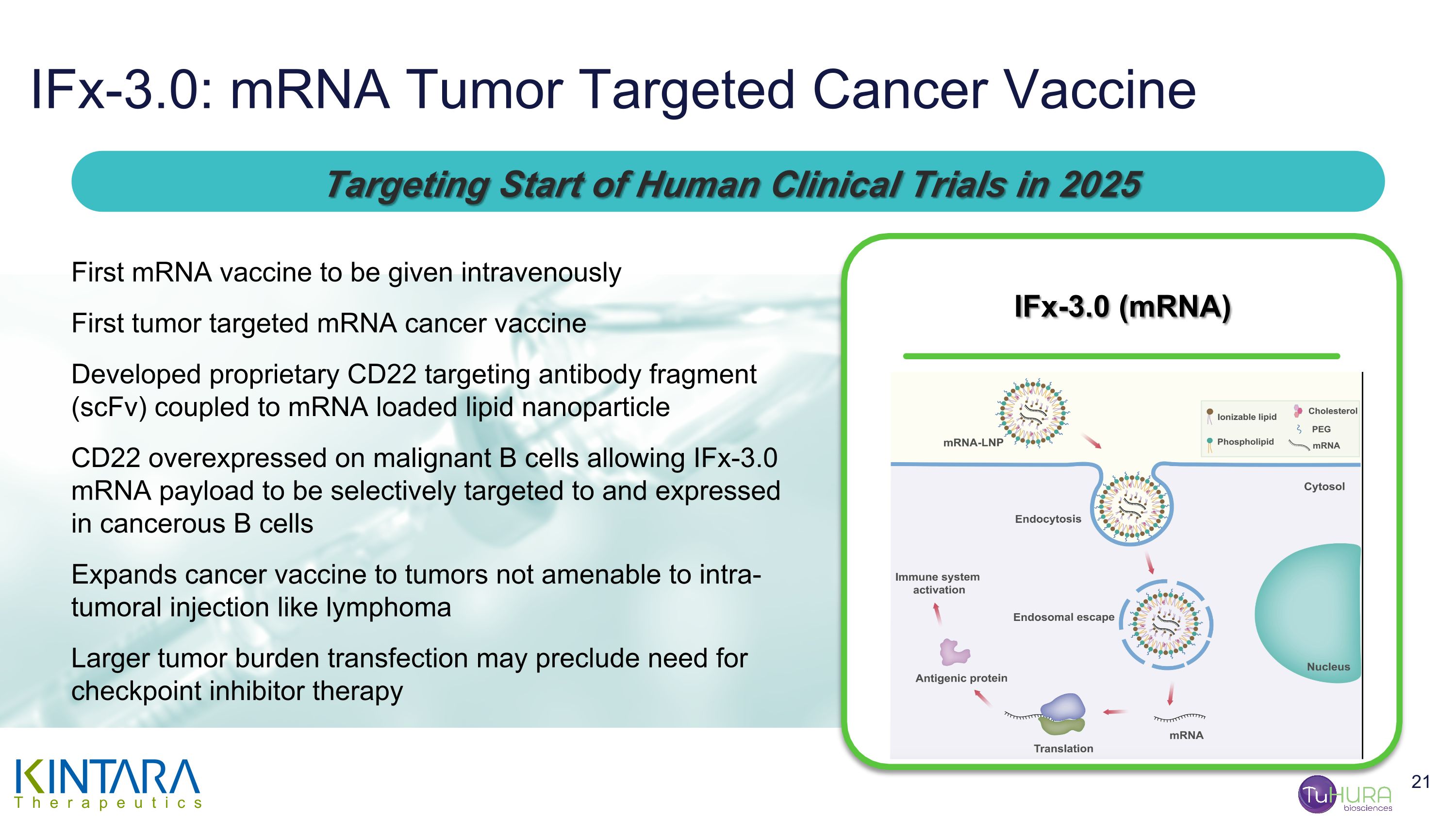

IFx-3.0: mRNA Tumor Targeted Cancer Vaccine Targeting Start of Human Clinical Trials in 2025 IFx-3.0 (mRNA) First mRNA vaccine to be given intravenously First tumor targeted mRNA cancer vaccine Developed proprietary CD22 targeting antibody fragment (scFv) coupled to mRNA loaded lipid nanoparticle CD22 overexpressed on malignant B cells allowing IFx-3.0 mRNA payload to be selectively targeted to and expressed in cancerous B cells Expands cancer vaccine to tumors not amenable to intra-tumoral injection like lymphoma Larger tumor burden transfection may preclude need for checkpoint inhibitor therapy

Bi-Functional ADC Inhibitors of MDSC Immune Suppression Designed to Overcome Acquired Resistance to Checkpoint Inhibitors and Cellular Therapies

Myeloid Derived Suppressor Cells (MDSCs) are a Major Obstacle for Immunotherapies Normally produced during pregnancy populate placenta to create an immune sanctuary to protect fetus from paternal foreign antigens “Hijacked” by tumors to populate tissue where tumor lives (microenvironment). Produce multiple immune suppressive factors, including iNOS, Arg-1 and IDO Provides tumor an Immune Sanctuary causing cellular therapies (T cell, NK cell) exhaustion and checkpoint inhibitors to stop working Targeting MDSC Immune Suppressing Function is an Attractive New Strategy to Overcome Acquired Resistance to Checkpoint Inhibitors and Cellular Therapies Novel Bi-Functional ADCs

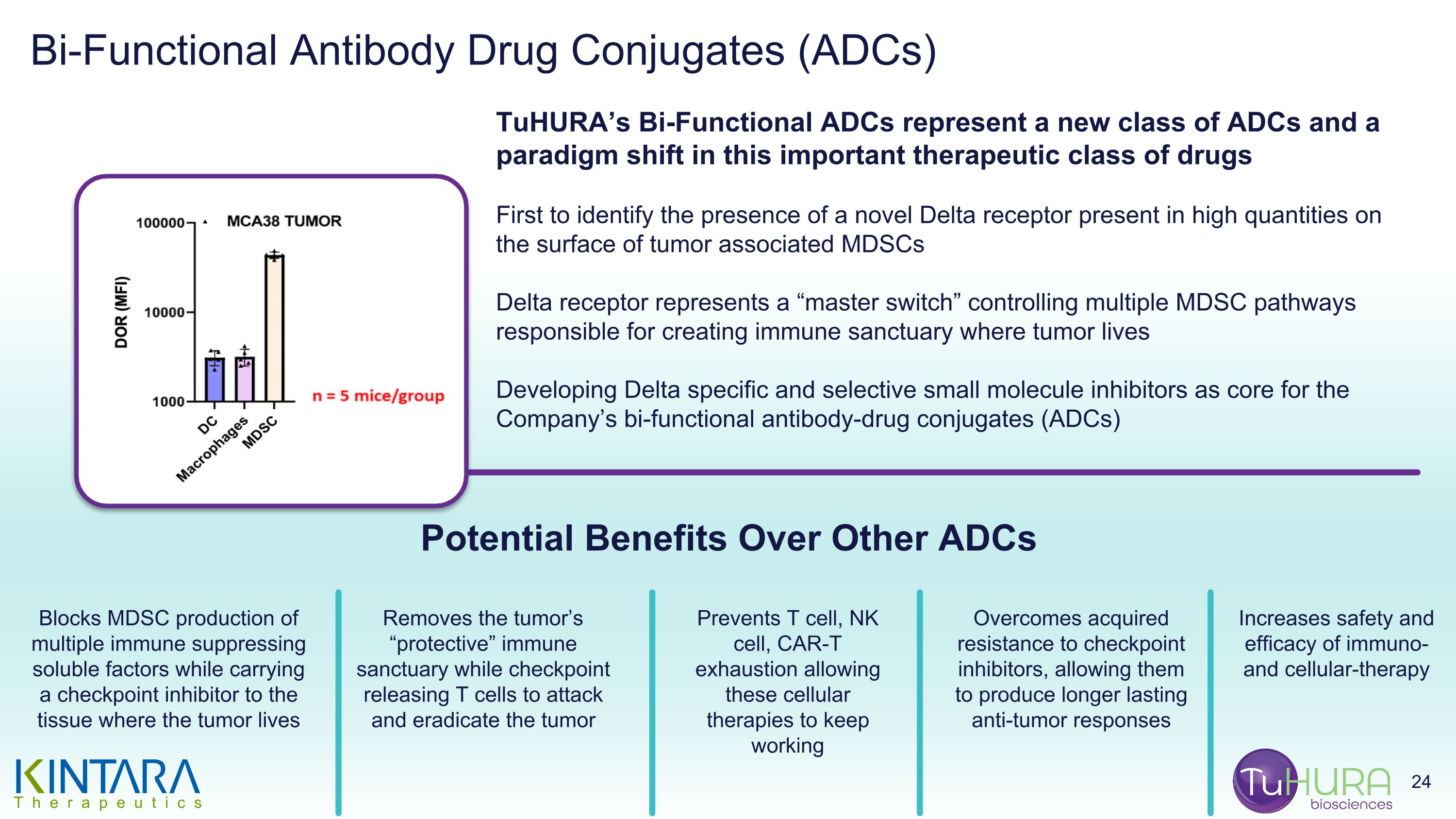

Bi-Functional Antibody Drug Conjugates (ADCs) Blocks MDSC production of multiple immune suppressing soluble factors while carrying a checkpoint inhibitor to the tissue where the tumor lives Removes the tumor’s “protective” immune sanctuary while checkpoint releasing T cells to attack and eradicate the tumor Prevents T cell, NK cell, CAR-T exhaustion allowing these cellular therapies to keep working Overcomes acquired resistance to checkpoint inhibitors, allowing them to produce longer lasting anti-tumor responses Increases safety and efficacy of immuno- and cellular-therapy Potential Benefits Over Other ADCs TuHURA’s Bi-Functional ADCs represent a new class of ADCs and a paradigm shift in this important therapeutic class of drugs First to identify the presence of a novel Delta receptor present in high quantities on the surface of tumor associated MDSCs Delta receptor represents a “master switch” controlling multiple MDSC pathways responsible for creating immune sanctuary where tumor lives Developing Delta specific and selective small molecule inhibitors as core for the Company’s bi-functional antibody-drug conjugates (ADCs)

President, CEO, CFO and Chairman of the Board Kintara Therapeutics Robert E. Hoffman

Legacy Kintara Assets Provide Opportunity for Potential Upside REM-001: In Development for the Treatment of Cutaneous Metastatic Breast Cancer (CMBC) Ongoing Open-Label Study Enrolling 15-patents with CMBC Evaluating safety and efficacy Funded by SBIR Grant from NIH FDA Fast Track Designation Potential Upside Provides opportunity for sale or out-license of asset if study is successful CVR earnout for Kintara shareholders upon enrollment of a minimum of 10 patients and if study shows an acceptable benefit risk profile

Among select group of accelerated approval Phase 3 oncology companies under SPA with FDA for novel trial design removing need for confirmatory trial Phase 3 results in Merkel Cell Carcinoma expected to be translatable to majority of cancers where checkpoint inhibitors don’t work Overcoming resistance to Keytruda® provides an attractive commercial opportunity Two Innovative Technology Platforms with Ability to Target Multiple High Value Oncology Indications Personalized Cancer Vaccines Bi-Functional ADC Inhibitors of MDSCs First to identify Delta receptor overexpressed on MDSCs Delta selective inhibitors remove MDSC immune suppression on tumor microenvironment Novel first-in-class bi-functional ADCs Sufficient Capital Expected to Fund Operations Through Mid-2025 Single Phase 3 trial for accelerated approval Attractive timeline and costs to Phase 3 trial results and potential FDA approval Basket trial could expand use to multiple tumor types IFx-3.0 represents next generation of tumor targeted cancer vaccines Summary

Enter into Definitive Merger Agreement Phase 3 Clinical Stage Immuno-Oncology Company Addressing Major Obstacles to Overcoming Resistance to Cancer Immunotherapy